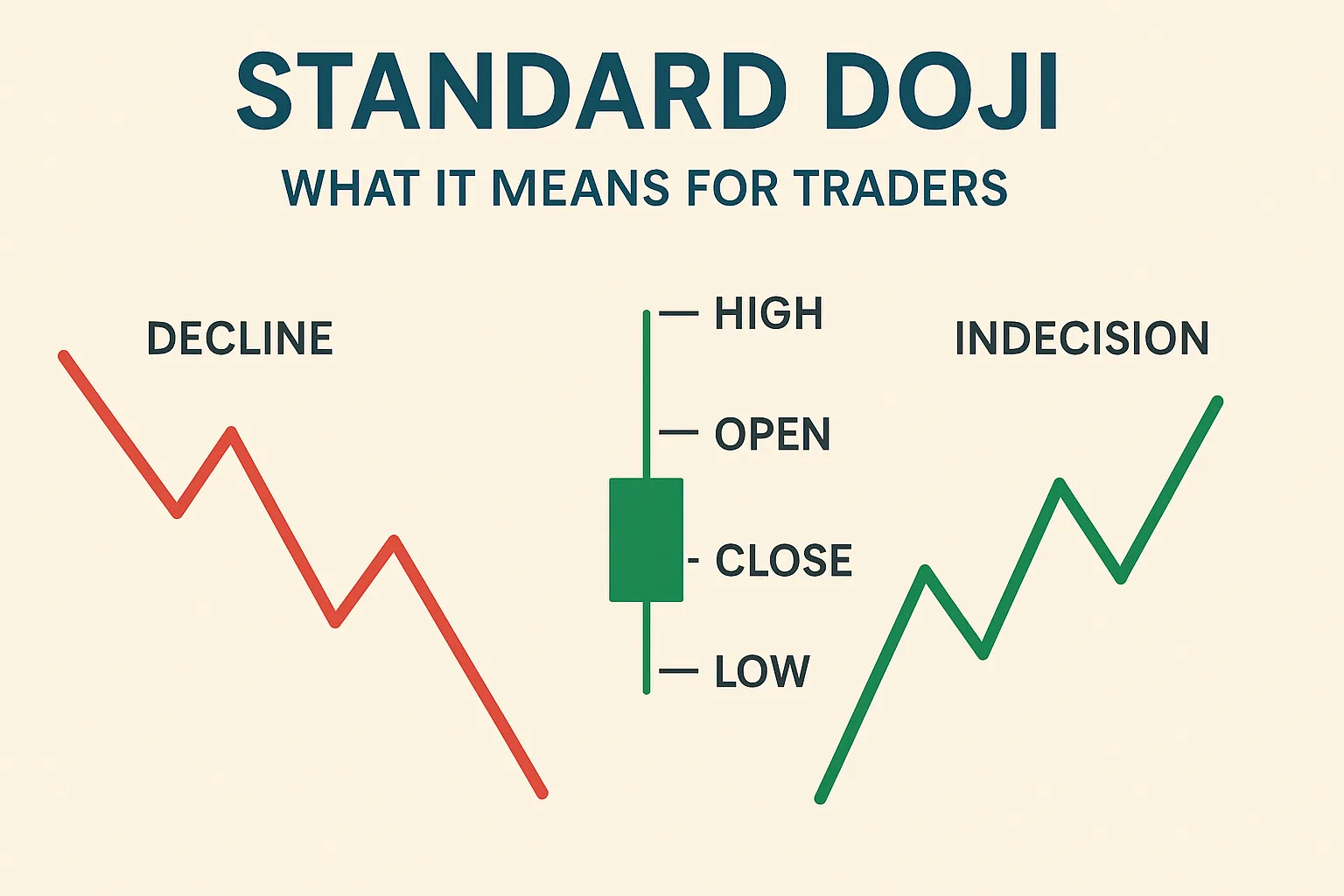

Introduction: Standard Doji Candlestick Meaning

The Standard Doji candlestick is one of the most recognised patterns in technical analysis. It signals market indecision and can hint at a potential reversal or continuation, depending on the trend context. For traders, understanding how to interpret and react to a Standard Doji can enhance decision-making and risk management.

What is a Standard Doji Candlestick ?

- Appearance: Open and close prices are almost identical, forming a small or no body with short upper and lower shadows.

- Psychology: Buyers and sellers are evenly matched, leading to uncertainty in price direction.

- Signal: Indicates pause or hesitation in the current trend.

When Does It Appear?

- In the middle of a trend: Could signal a pause before continuation.

- At support/resistance: Might suggest a possible reversal.

- During low volume sessions, Reflects lack of commitment from both sides.

How to Trade the Standard Doji

- Analyse the Trend: The meaning depends on its position in the trend.

- After an uptrend: Possible bearish reversal.

- After a downtrend: Possible bullish reversal.

- Wait for Confirmation: A strong candle after the Doji provides direction.

- Entry Point: Trade after the confirmation candle breaks above or below the Doji.

- Stop-Loss: Set beyond the Doji’s high or low.

- Targets: Use support/resistance levels or standard risk-reward ratios.

When is the Standard Doji Most Useful?

- At key levels: It provides early warnings of potential trend shifts.

- With volume spikes: Adds credibility to its signal.

- Alongside other indicators: Enhances accuracy (e.g., RSI, MACD).

FAQs: Standard Doji Candlestick

1. Is the Standard Doji a reversal signal?

It can be, but it depends on the trend context. Always wait for confirmation.

2. Can I trade based on the Doji alone?

No. Doji represents indecision, not action. Confirmation is critical.

3. What’s the difference between Standard Doji and Long-Legged Doji?

- Standard Doji: Short wicks, less volatility.

- Long-Legged Doji: Long wicks, shows high volatility and indecision.

4. Which time frames are best?

Standard Doji is effective on 1-hour, 4-hour, and daily charts.

5. Does volume matter with Doji patterns?

Yes. A Doji with high volume is more likely to result in a significant move.

Conclusion

The Standard Doji is a vital pattern for traders to recognize neutral sentiment in the market. While it doesn’t guarantee a reversal, it offers a signal to pause, observe, and prepare for a possible shift. By combining Doji analysis with trend context and confirmation, traders can use it to sharpen their strategy.