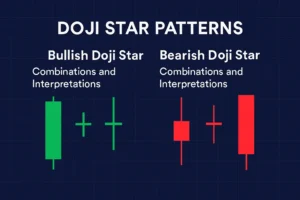

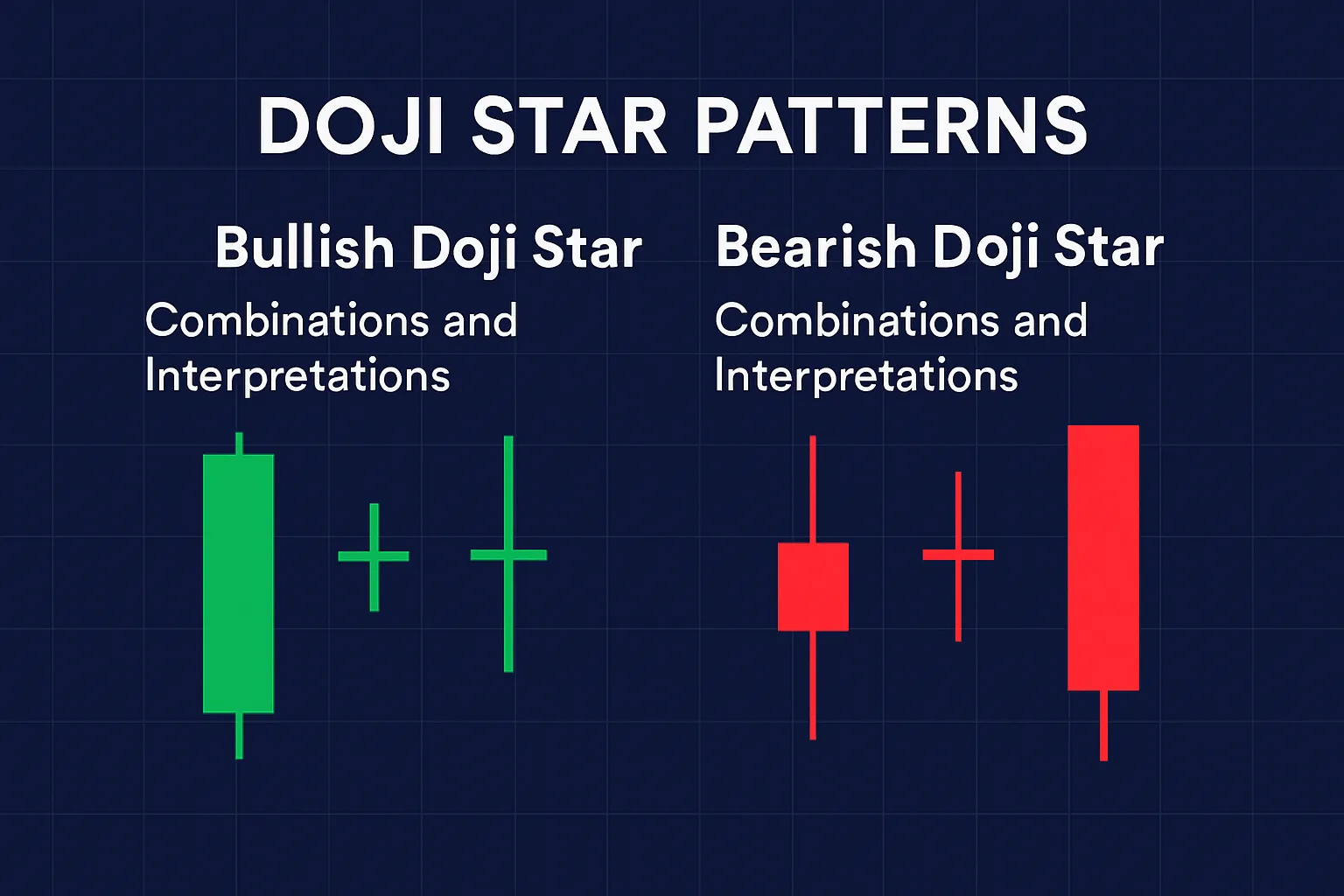

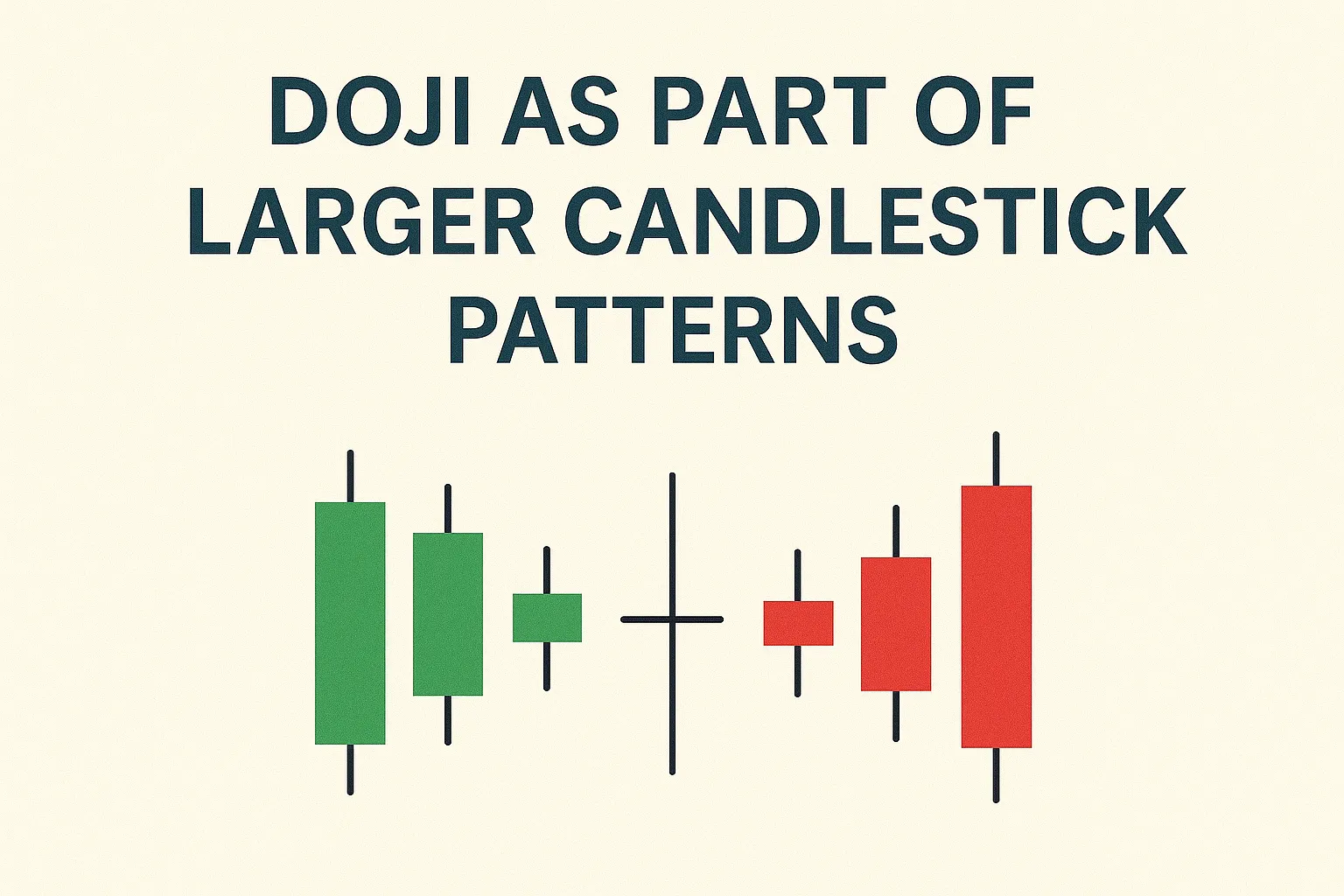

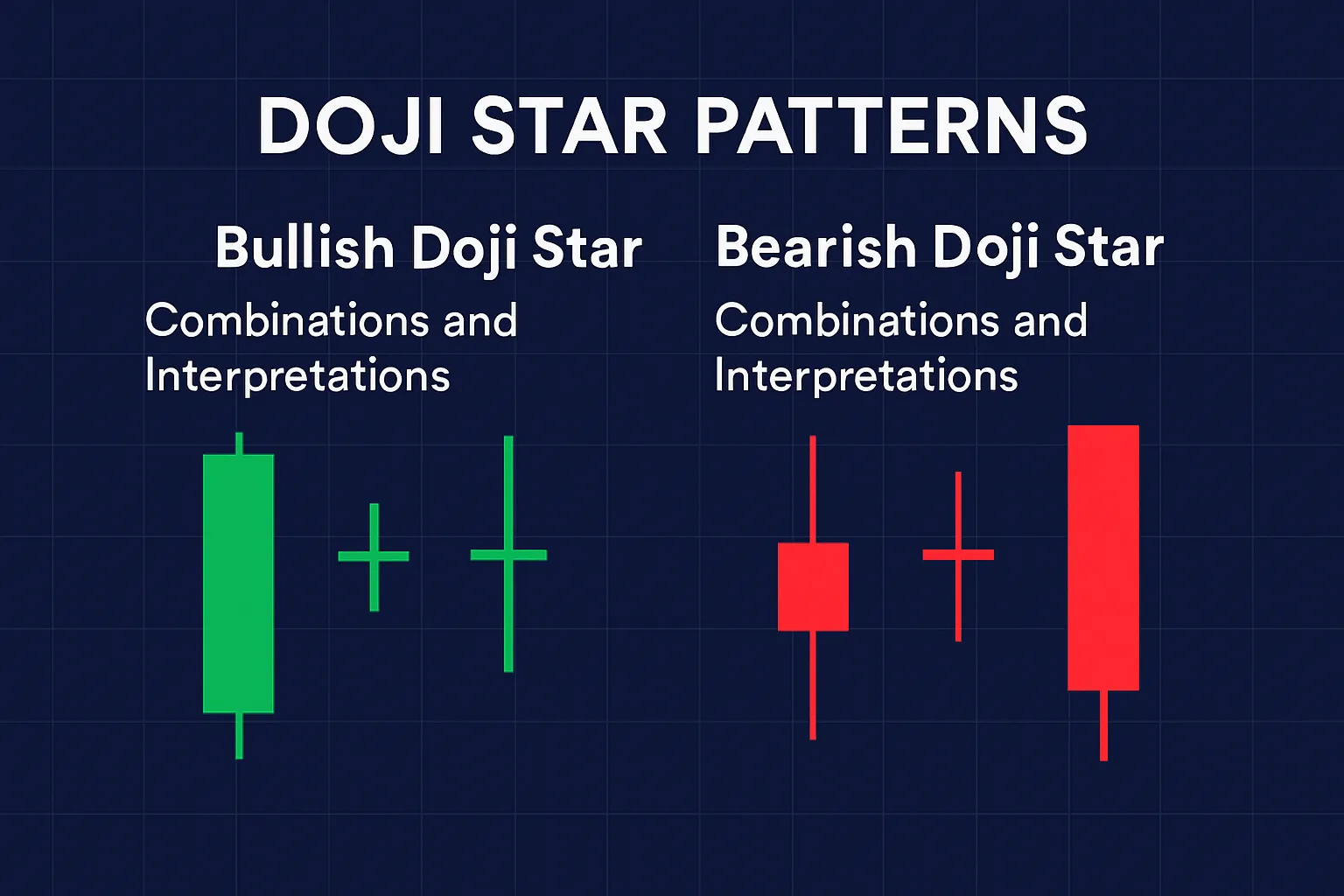

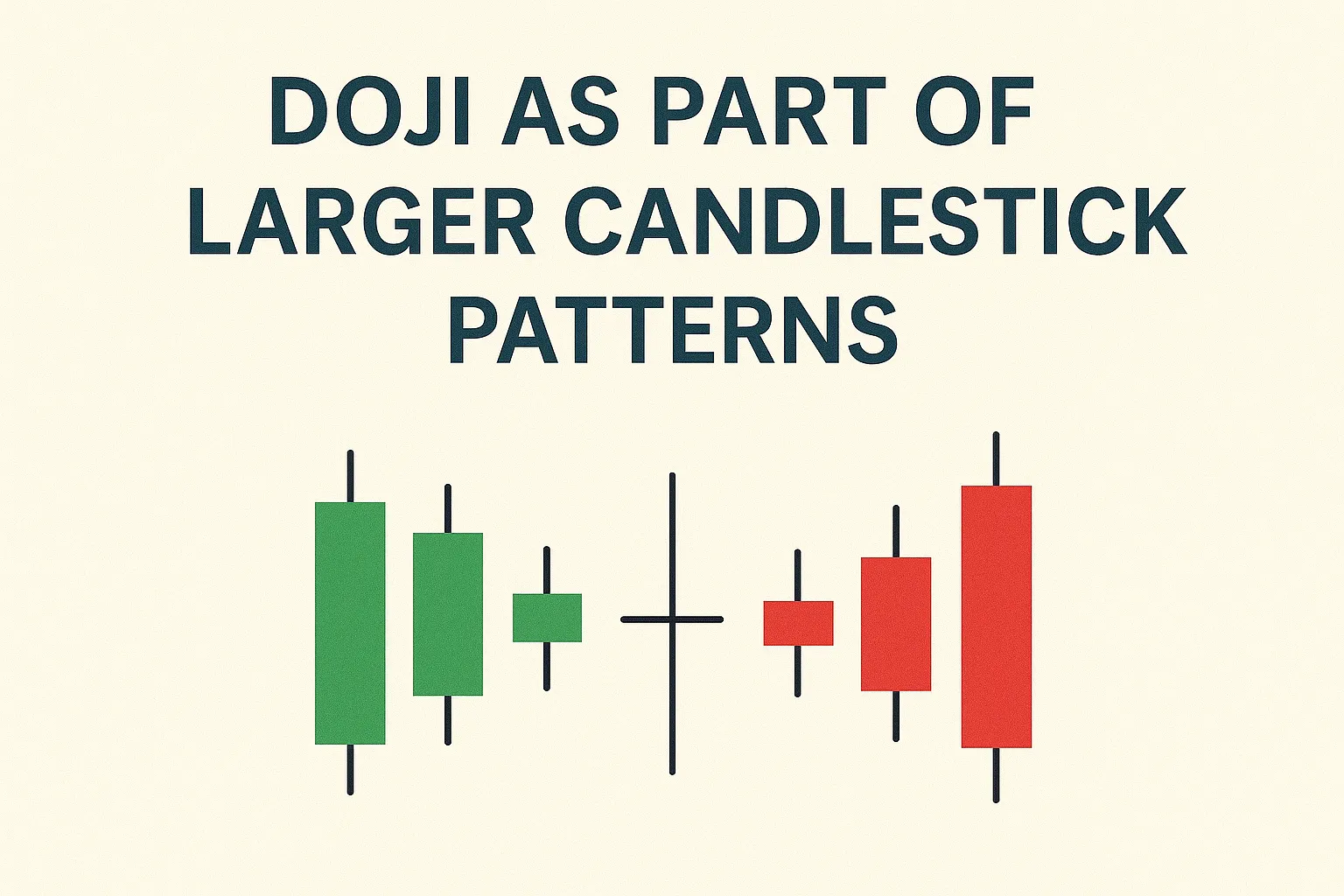

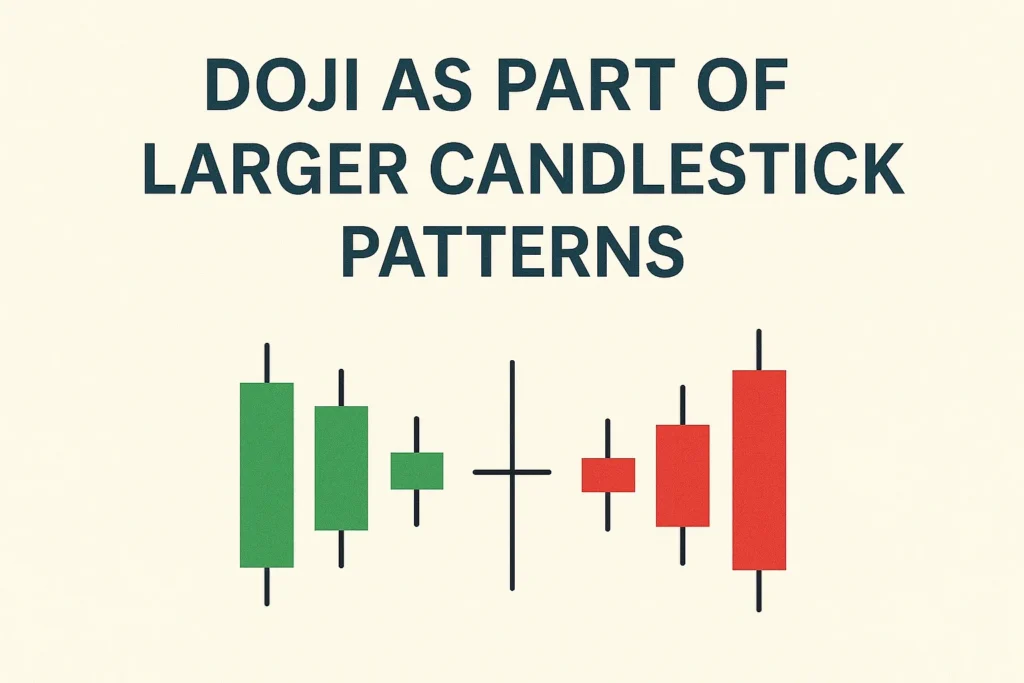

Introduction Doji Star patterns are multi-candle formations that include a Doji as part of a larger reversal pattern. These combinations

Introduction Doji candlestick patterns are powerful tools for identifying market indecision. While they don’t signal trades on their own, when

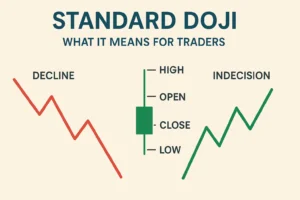

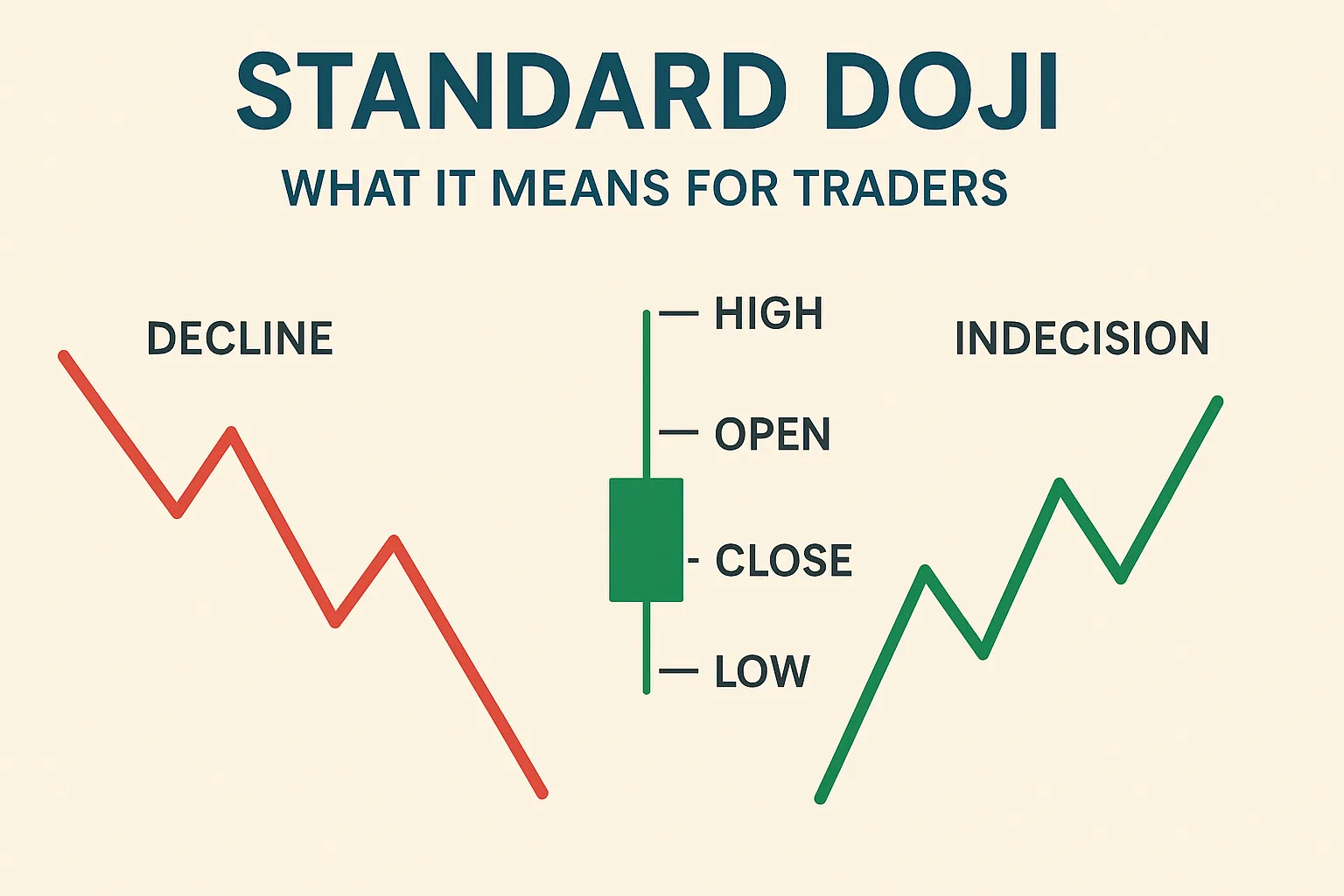

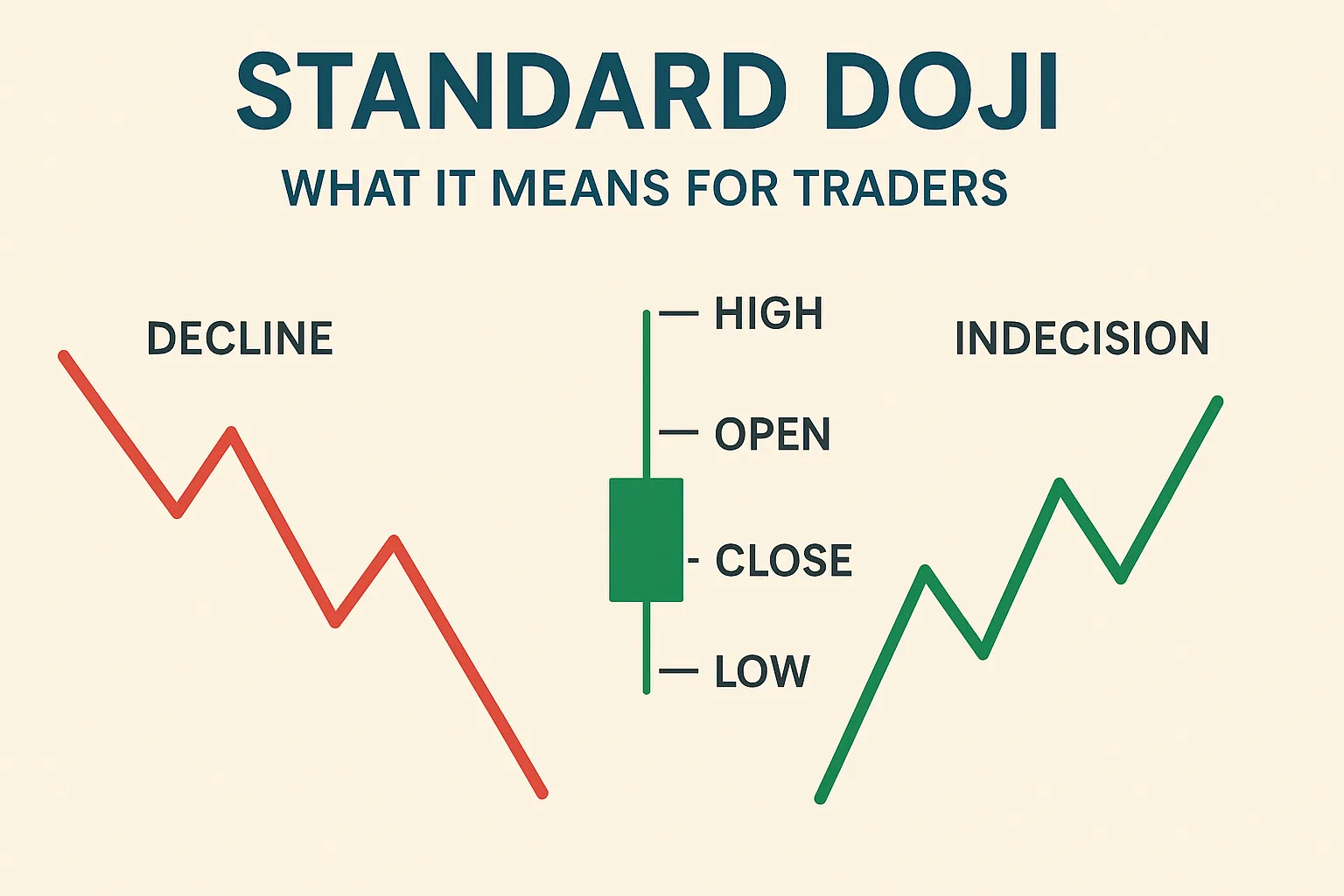

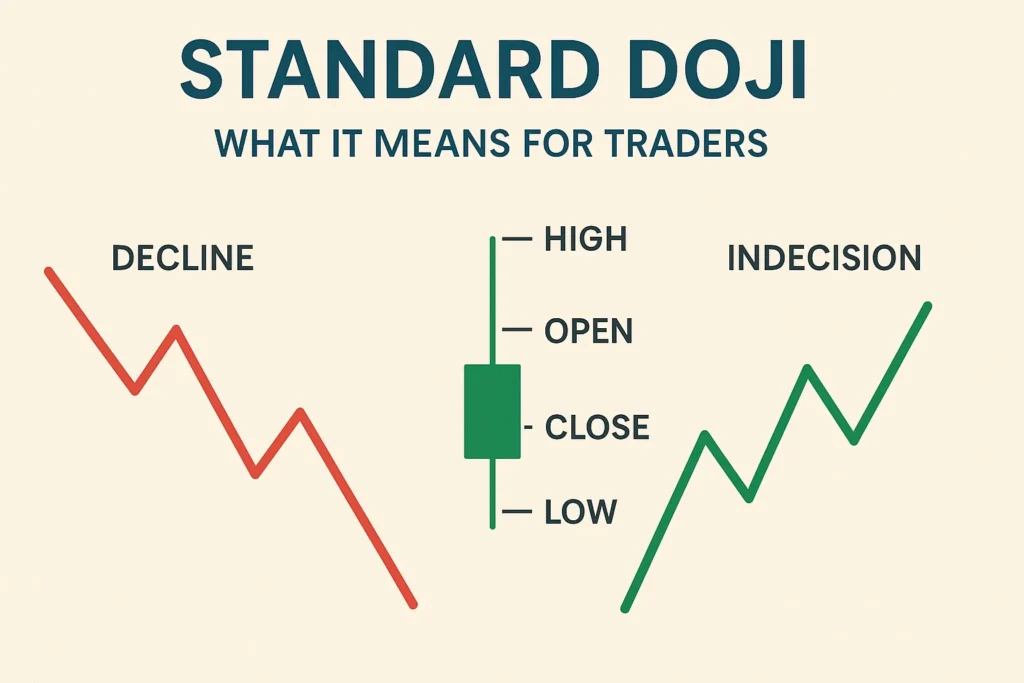

Introduction: Standard Doji Candlestick Meaning The Standard Doji candlestick is one of the most recognised patterns in technical analysis. It

Introduction Long-Legged Doji Market Indecision The Long-Legged Doji is a unique candlestick pattern that represents extreme indecision in the market.

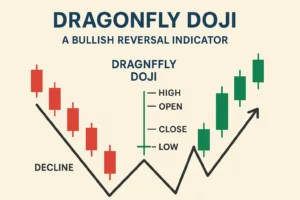

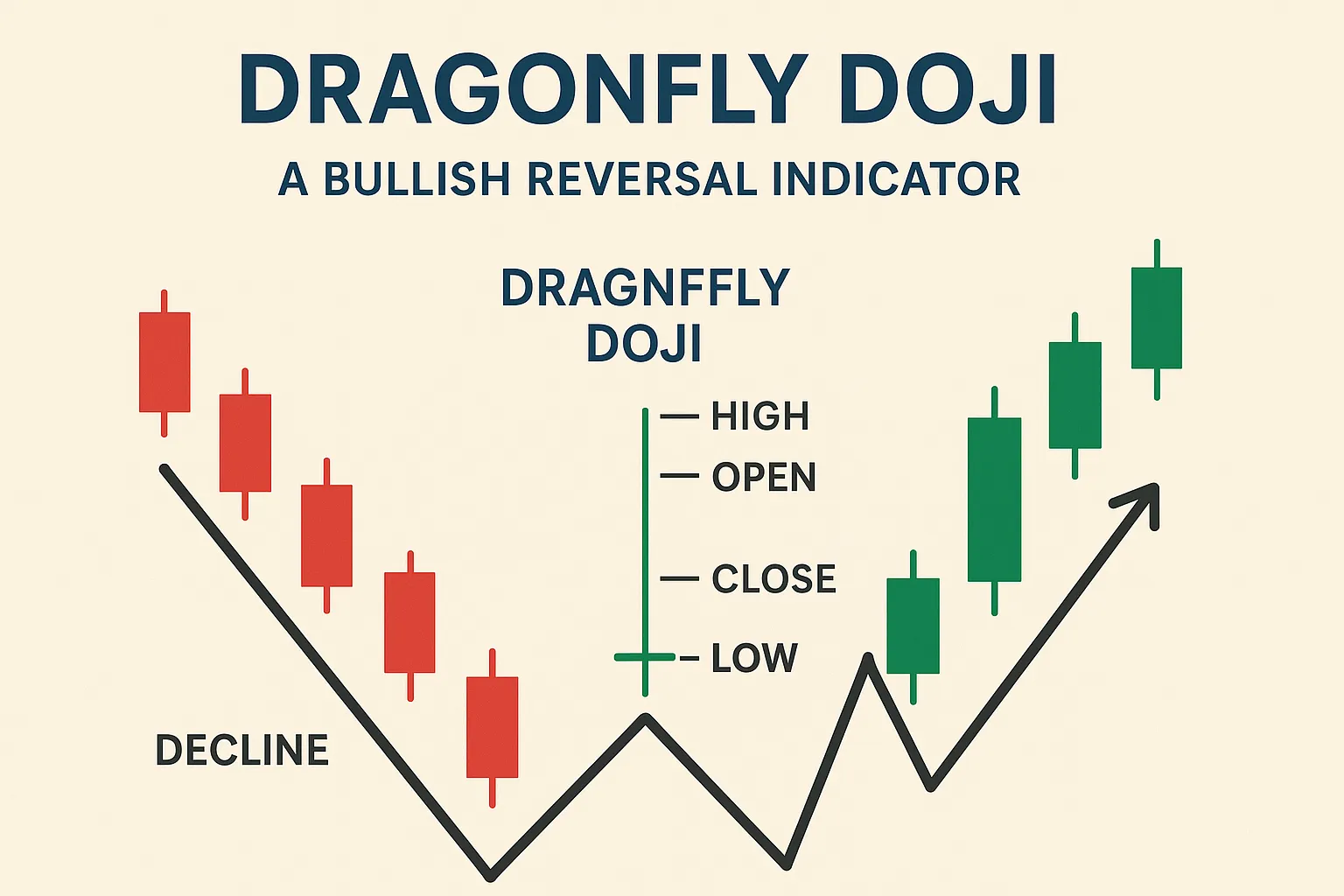

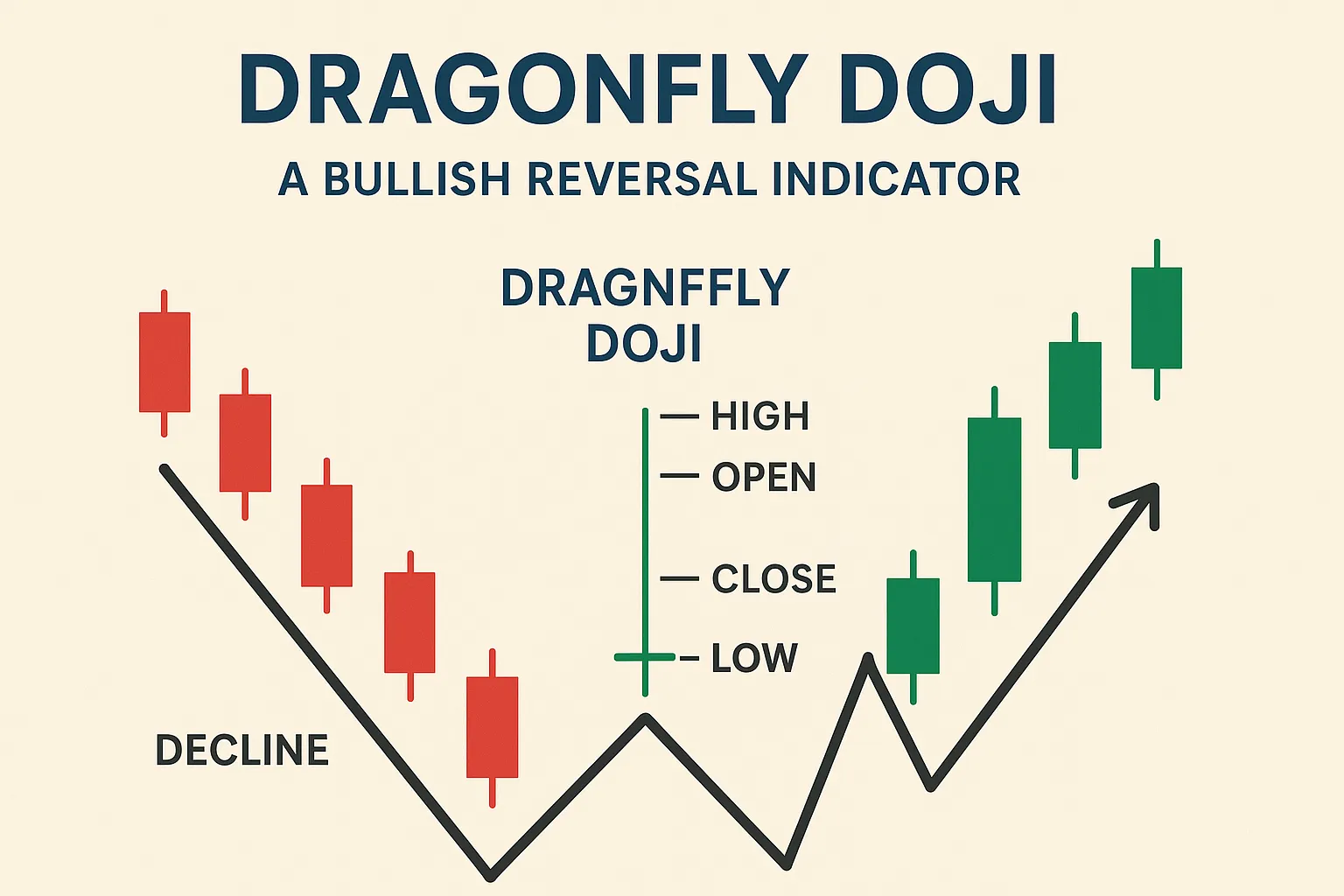

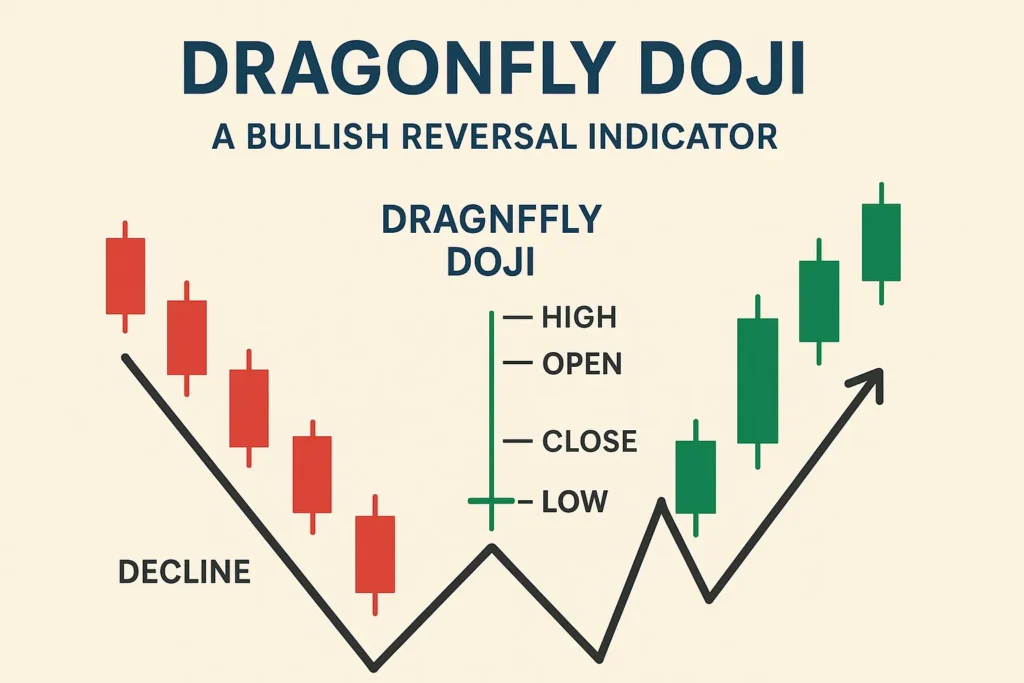

Introduction The Dragonfly Doji is a rare but powerful bullish reversal candlestick pattern that signals a shift from selling pressure

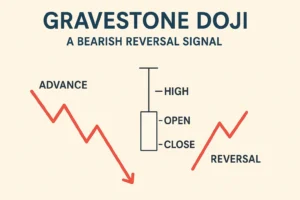

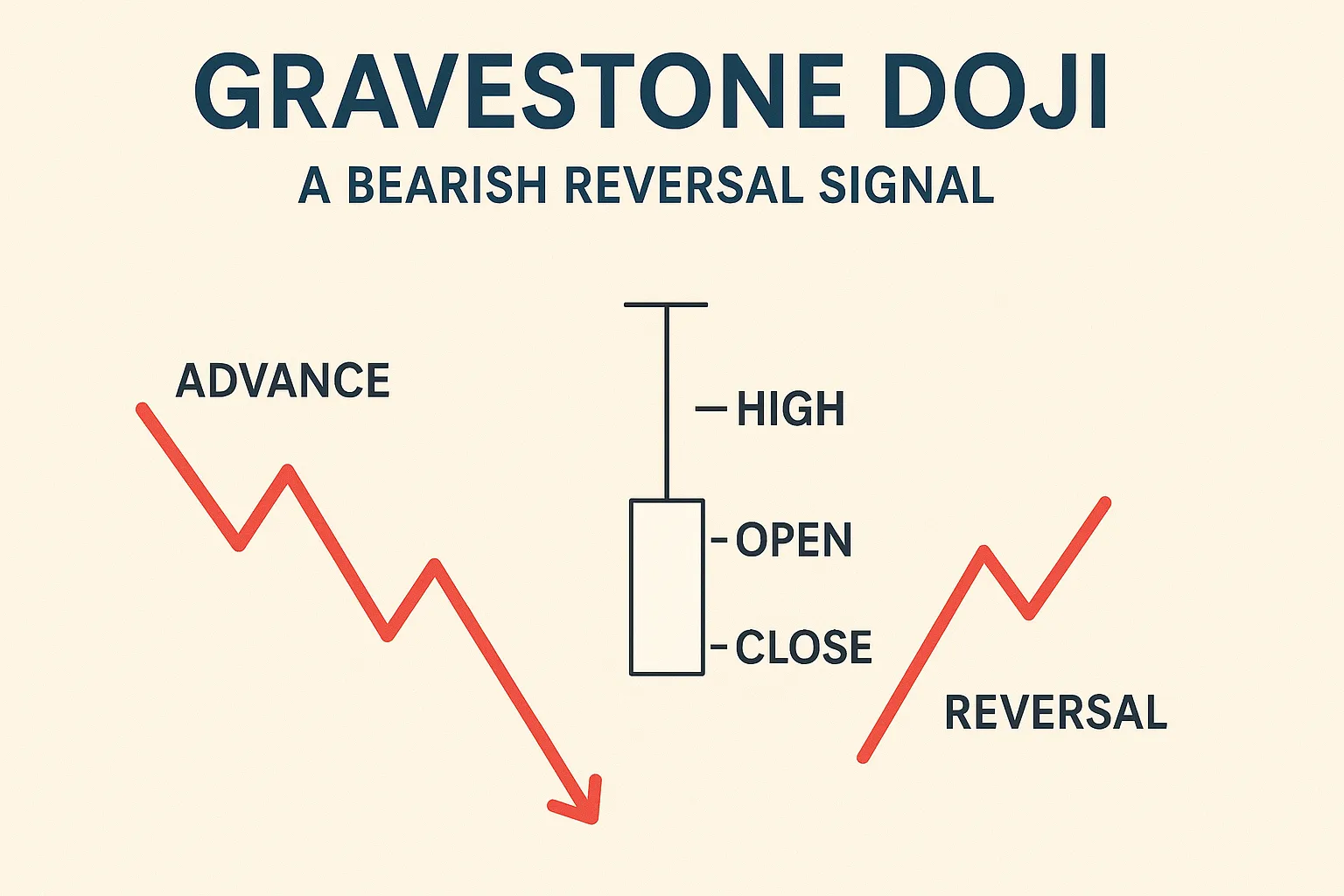

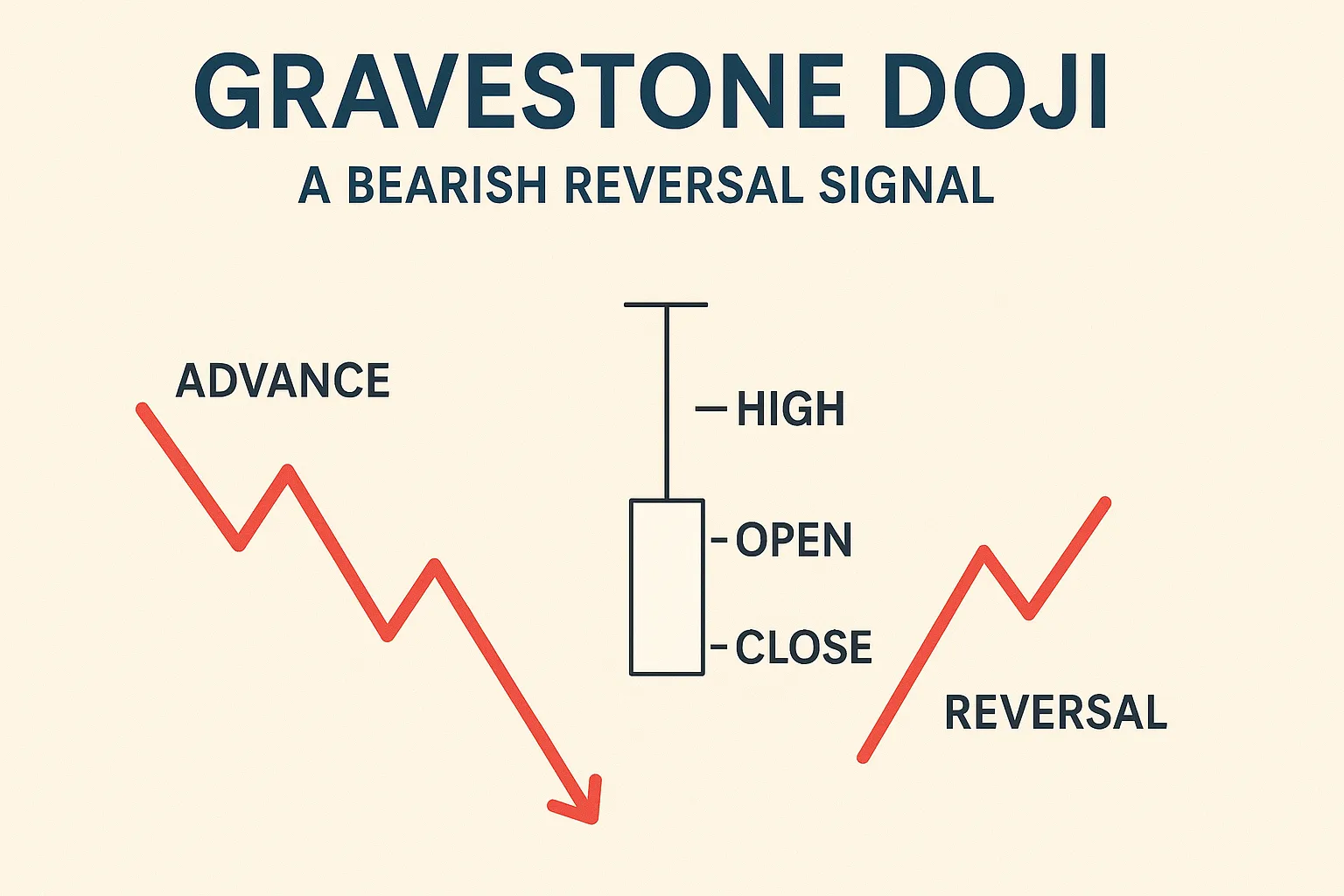

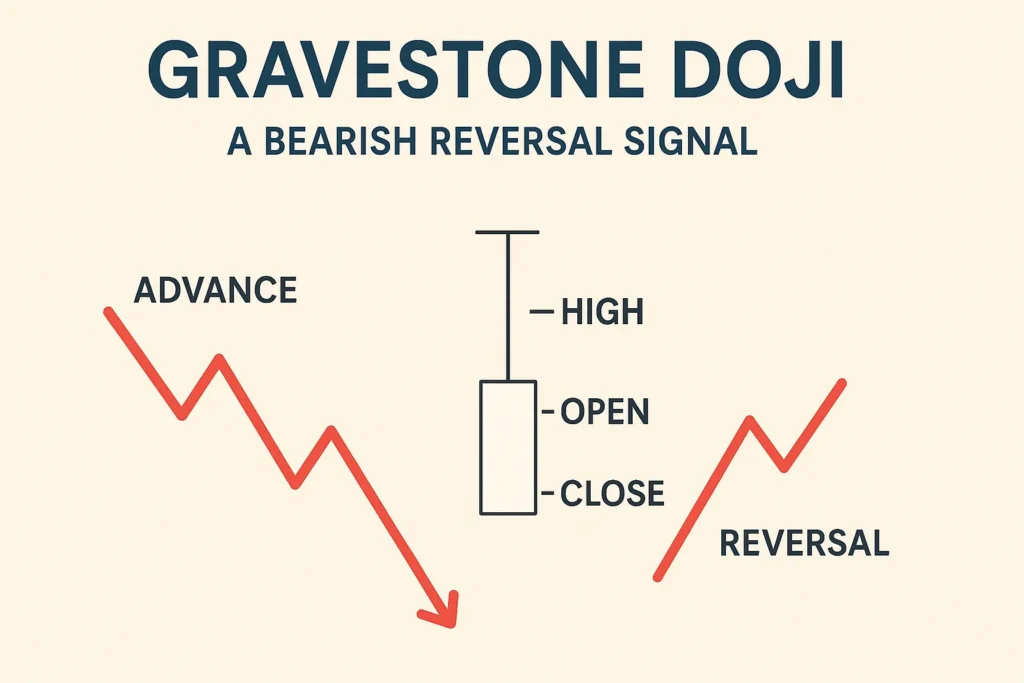

IntroductionThe Gravestone Doji is a powerful bearish reversal candlestick pattern that often appears at the top of an uptrend. It

IntroductionNot all Doji candlesticks are the same. While they all represent market indecision, the shape and position of a Doji

IntroductionA Doji candlestick is a powerful signal in technical analysis, representing market indecision. It forms when the opening and closing

Introduction of Doji Candle Color Meaning Traders often wonder if the colour of a Doji candlestick — whether it’s green or red — affects its meaning.

IntroductionA Doji candlestick can stand alone as a sign of indecision, but when combined with other candlesticks, it becomes a

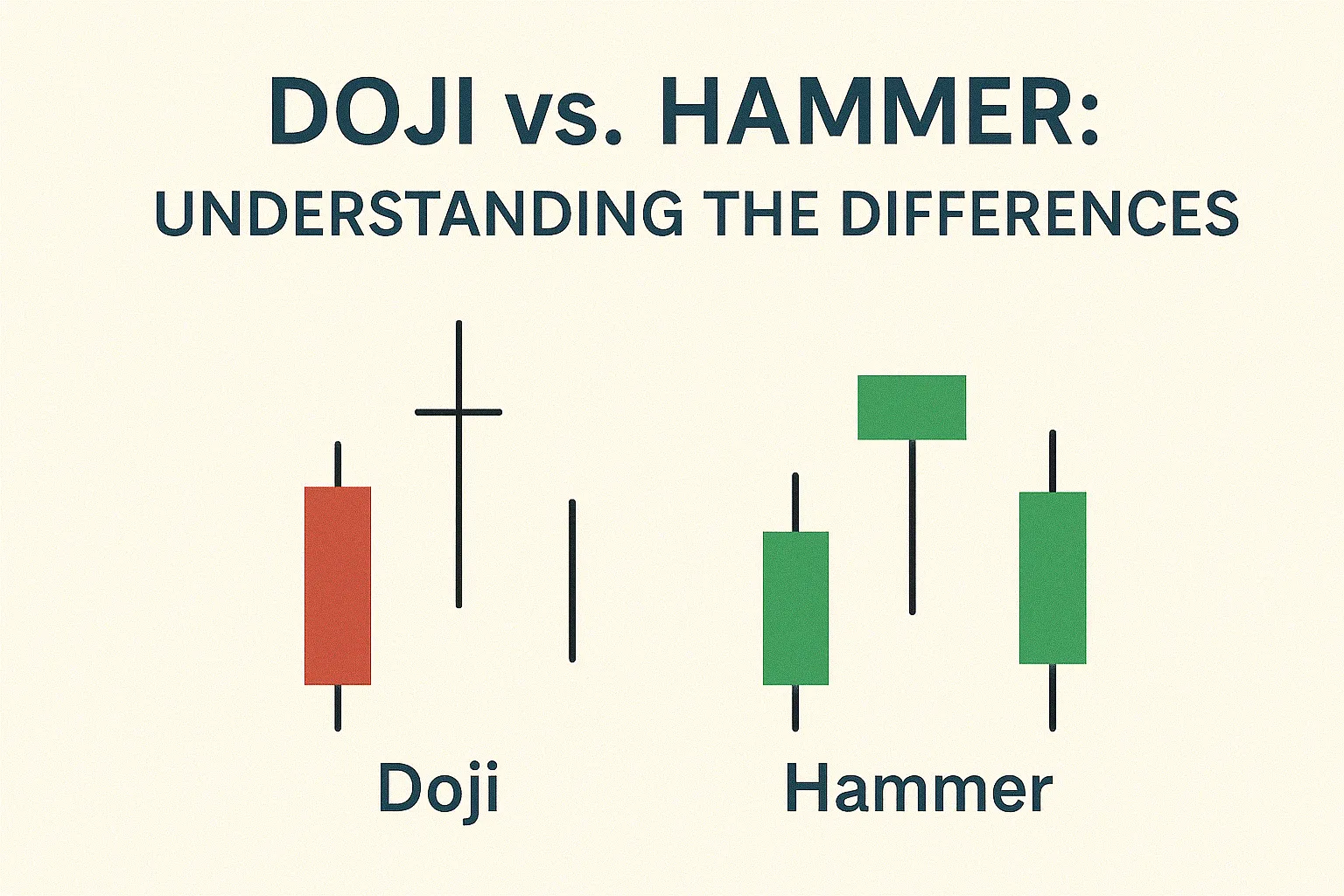

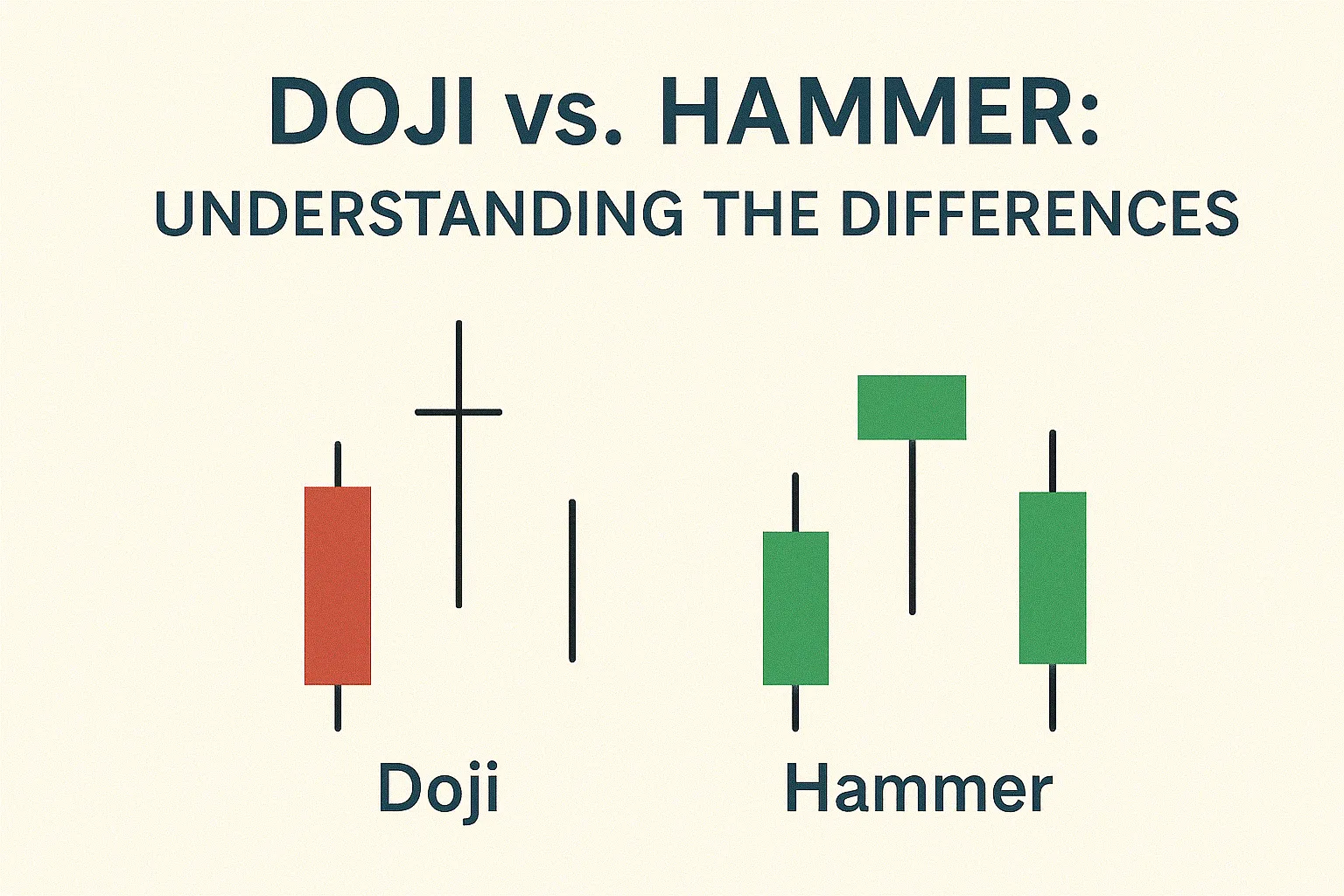

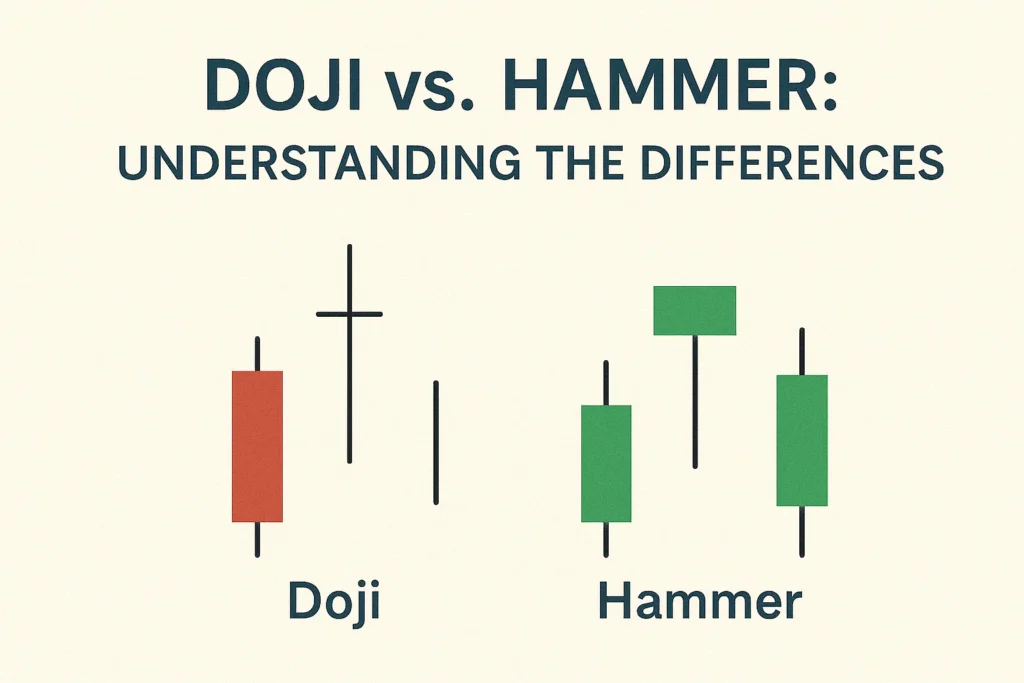

ntroductionBoth Doji and Hammer candlesticks are used to spot potential market reversals, but they have distinct formations and meanings. Misunderstanding

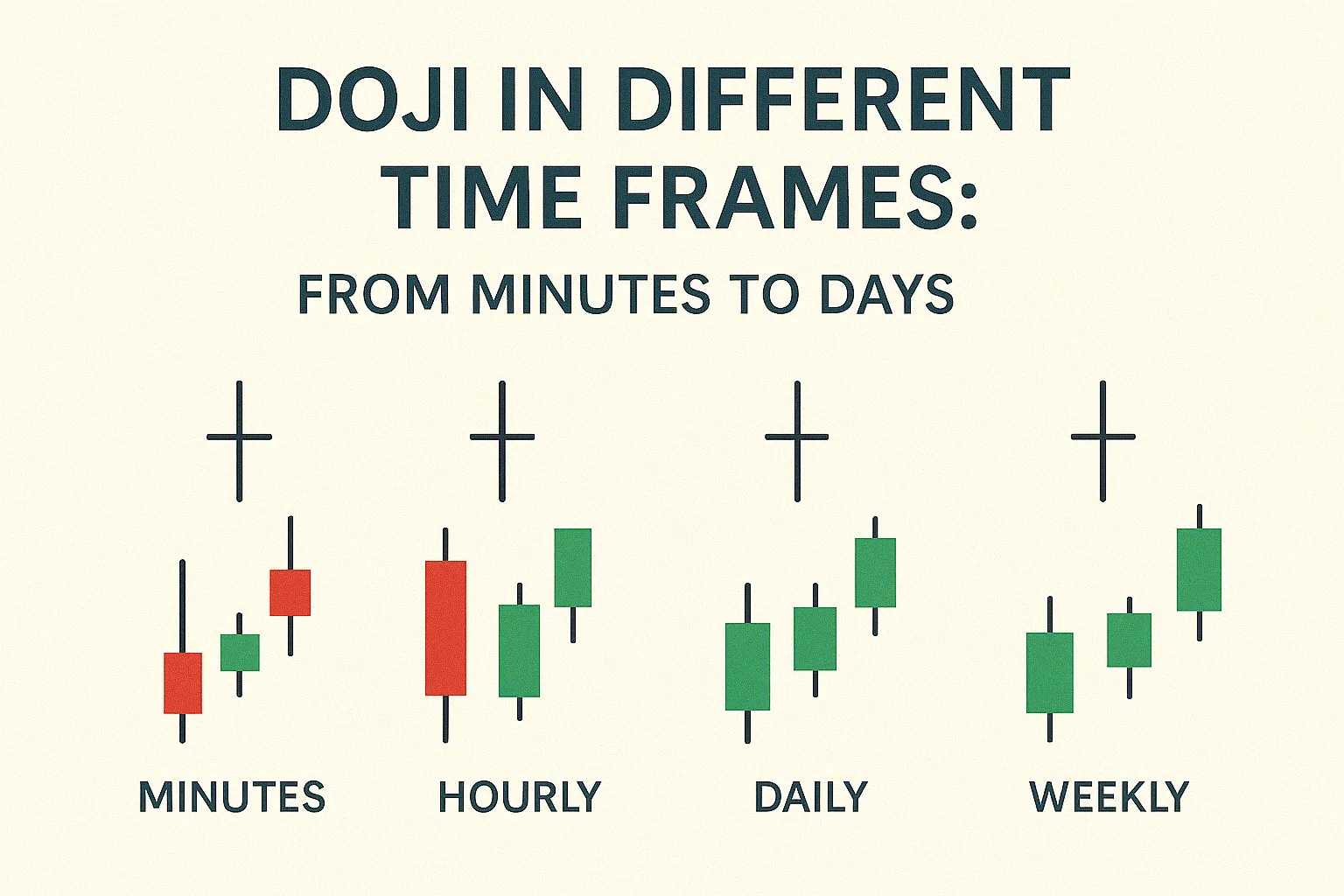

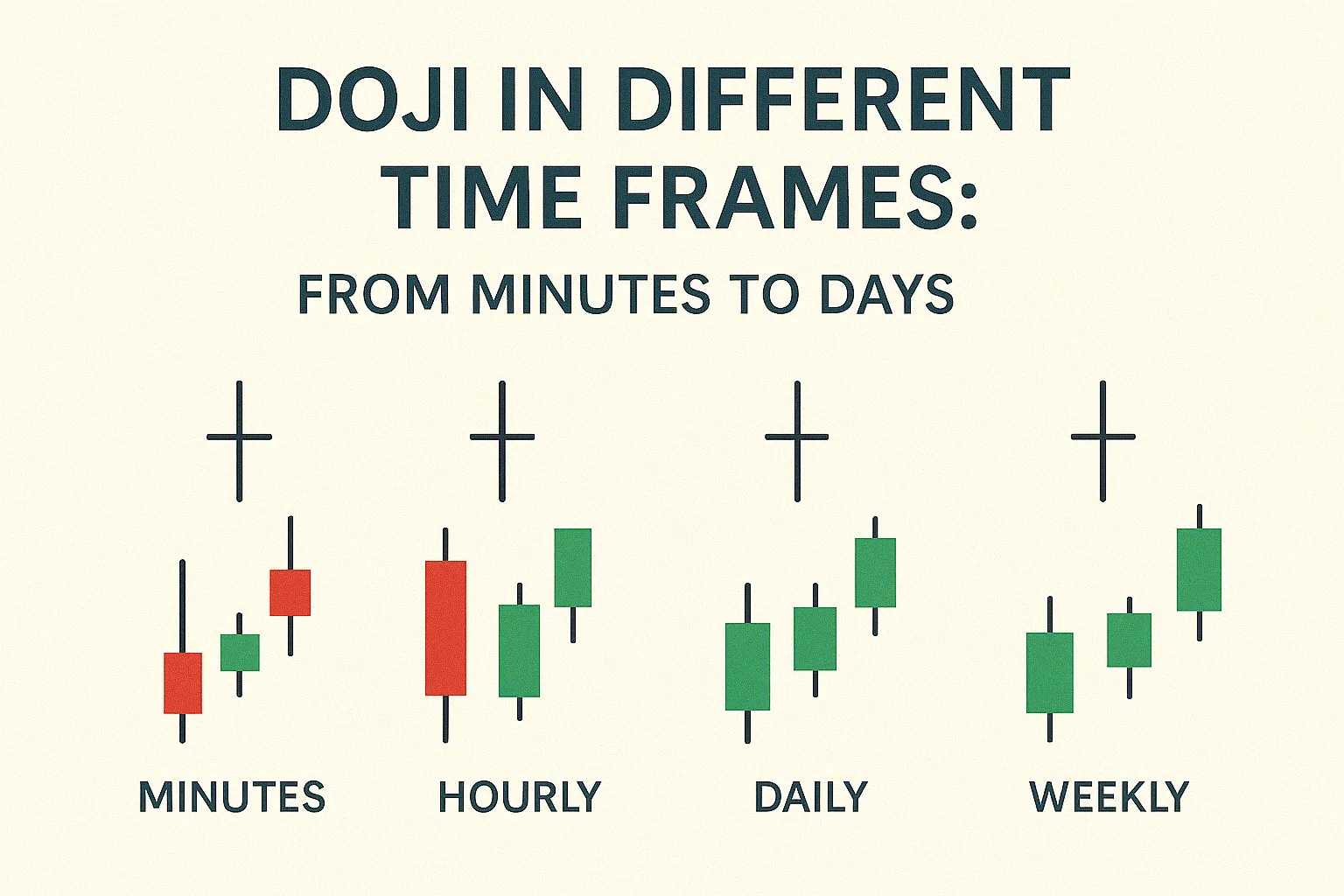

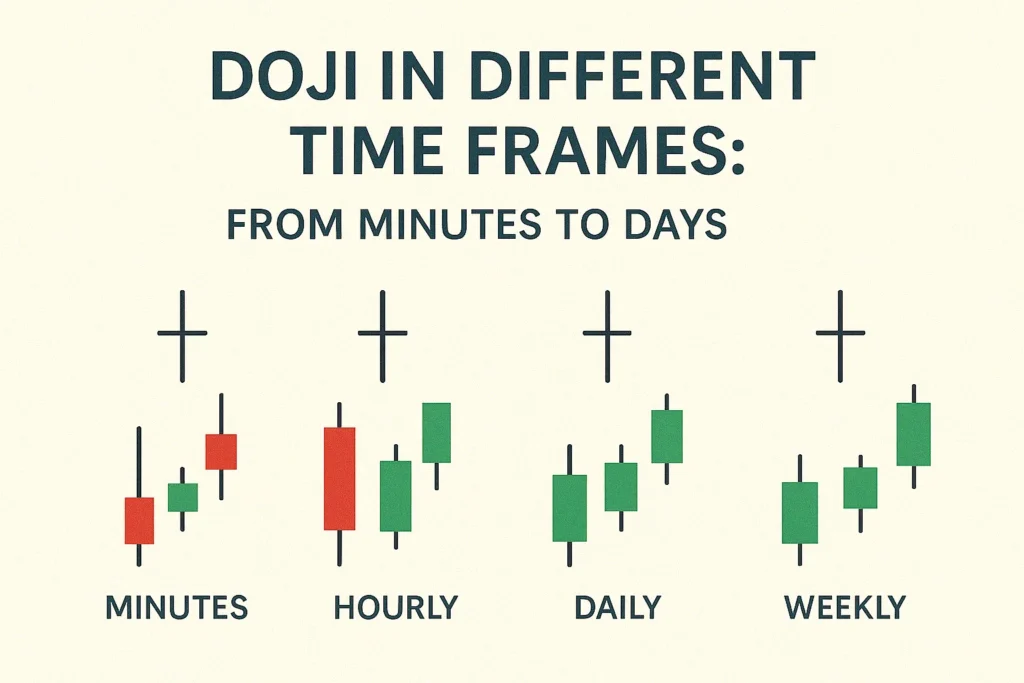

IntroductionThe effectiveness of Doji candlesticks varies greatly depending on the time frame you're trading. While a Doji on a daily

Subscribe our newsletter for latest news, blog posts. Let’s stay updated!

Featured News

YOUR ADS HERE

Ready to take your business to the next level?

Latest News

“Understanding Doji was the turning point in my trading journey.”

– Stephane Lanke

ABOUT DOJICANDLE

Mastering Market Signals Starts With a Single Candle

DojiCandles reveal moments of indecision in the market — a subtle yet powerful signal for traders. At DojiCandle.com, we help you decode these signals with clarity and confidence. Whether you’re new to candlestick analysis or an experienced trader refining your strategy, our platform offers simple, actionable insights to guide your trading decisions.

From detailed tutorials to real-world examples, we explore the psychology behind each pattern and how to use them effectively across different market conditions. Start reading the charts like a pro and take your trading strategy to the next level.

Editor's Pick

Introduction Doji Star patterns are multi-candle formations that include a Doji as part of a larger reversal pattern. These combinations

Introduction Doji candlestick patterns are powerful tools for identifying market indecision. While they don’t signal trades on their own, when

Introduction: Standard Doji Candlestick Meaning The Standard Doji candlestick is one of the most recognised patterns in technical analysis. It

Introduction Long-Legged Doji Market Indecision The Long-Legged Doji is a unique candlestick pattern that represents extreme indecision in the market.

Introduction The Dragonfly Doji is a rare but powerful bullish reversal candlestick pattern that signals a shift from selling pressure

IntroductionThe Gravestone Doji is a powerful bearish reversal candlestick pattern that often appears at the top of an uptrend. It

IntroductionNot all Doji candlesticks are the same. While they all represent market indecision, the shape and position of a Doji

IntroductionA Doji candlestick is a powerful signal in technical analysis, representing market indecision. It forms when the opening and closing

Introduction of Doji Candle Color Meaning Traders often wonder if the colour of a Doji candlestick — whether it’s green or red — affects its meaning.

IntroductionA Doji candlestick can stand alone as a sign of indecision, but when combined with other candlesticks, it becomes a

ntroductionBoth Doji and Hammer candlesticks are used to spot potential market reversals, but they have distinct formations and meanings. Misunderstanding

IntroductionThe effectiveness of Doji candlesticks varies greatly depending on the time frame you're trading. While a Doji on a daily