Introduction

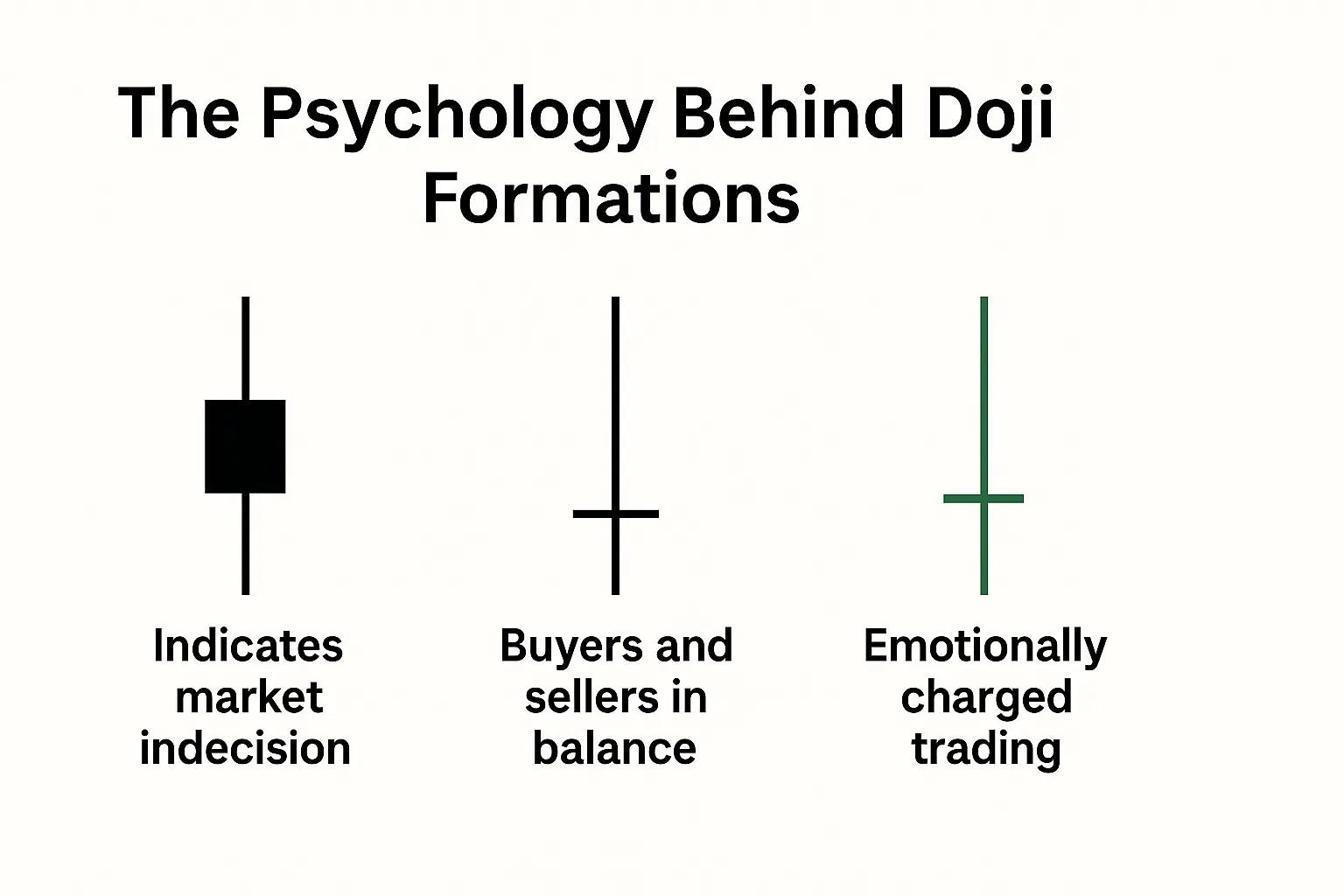

Candlestick patterns are not just visual tools—they reflect the emotions and psychology of market participants. Among these, the Doji candlestick stands out as a powerful symbol of indecision. To fully understand the significance of Doji patterns, traders must look beyond the chart and into the psychological battle taking place between buyers and sellers.

What Is a Doji Candlestick?

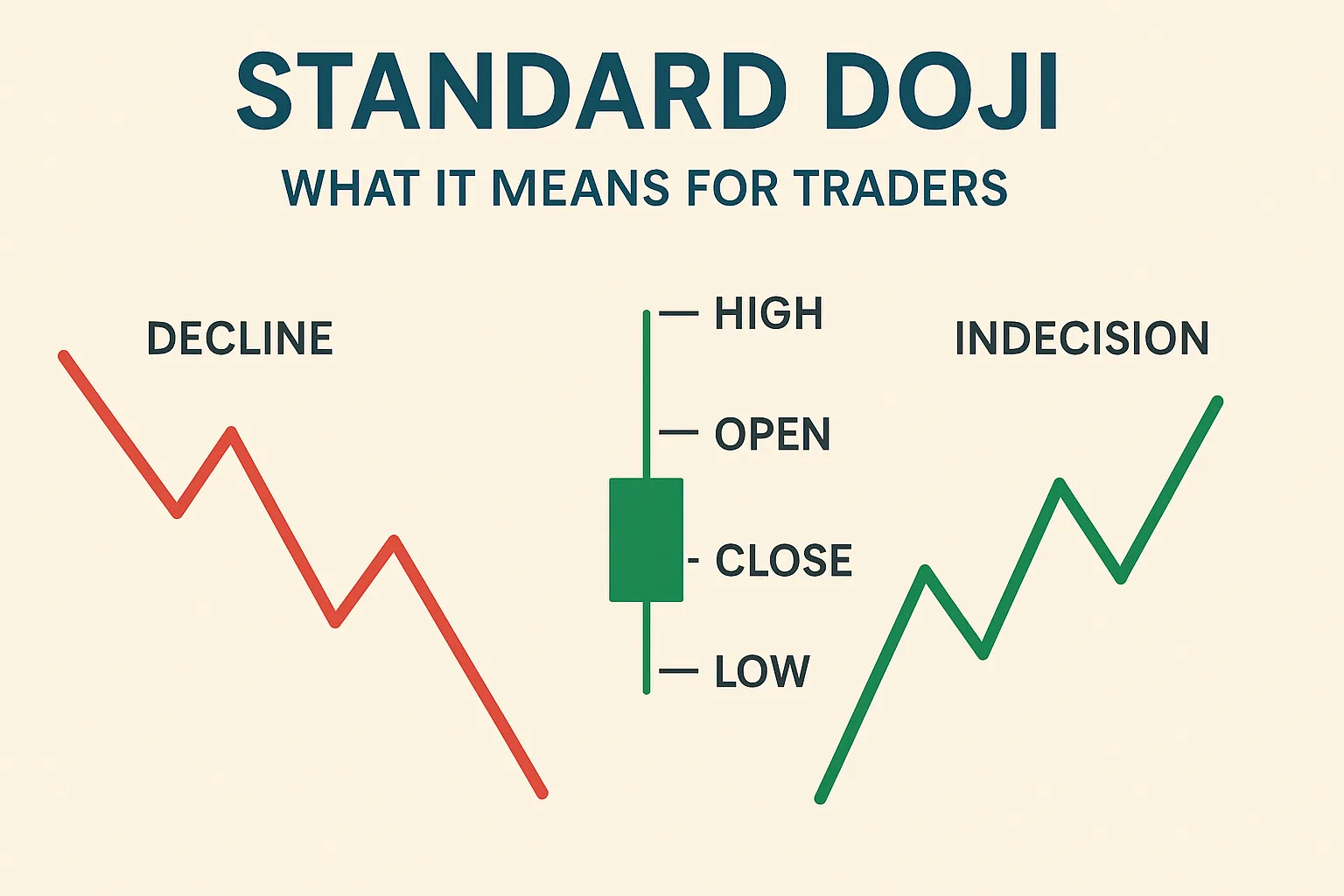

A Doji forms when the opening and closing prices of a trading session are nearly identical. The result? A candle with no real body, only shadows. This pattern indicates that neither bulls nor bears could dominate the session, leading to market equilibrium.

The Emotional Tug-of-War Behind a Doji

- Uncertainty in the Market

When a Doji forms, traders are often uncertain about the future direction. They hesitate, waiting for more signals or external news. - Equal Strength

Bulls try to push prices up, bears try to pull them down—but by the end, neither side wins. This balance reflects conflicted market sentiment. - Fear of Missing Out (FOMO)

Often, traders who see trends starting or ending may hesitate, causing smaller price movements that result in a Doji. This reflects a pause before big moves. - Waiting for Confirmation

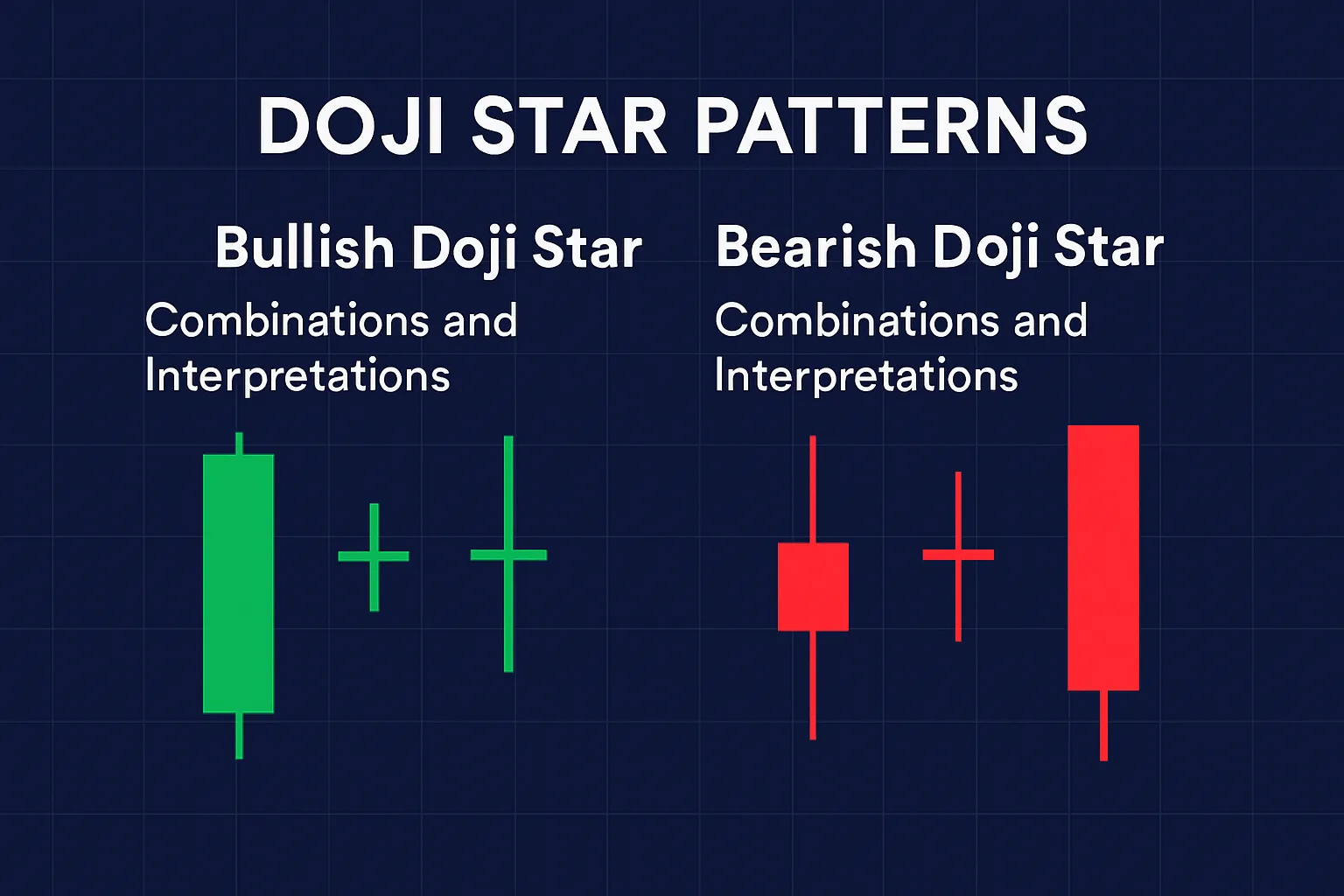

After significant rallies or drops, markets take a breath. Traders wait for the next candle to confirm if the current trend continues or reverses.

Types of Market Psychology Leading to Dojis

- After Strong Trends: Traders are unsure if momentum will continue.

- At Key Support/Resistance Levels: Market pauses, testing strength.

- During Low Volume: Lack of participation leads to indecision.

How to Use Psychology in Trading Dojis

- Recognize Indecision

A Doji shows the market is undecided. It’s not a buy/sell signal alone but a warning to watch for further action. - Combine with Volume

Low volume Dojis may be ignored, but a Doji with high volume can signal a major shift in sentiment. - Wait for the Breakout

The candle following a Doji often reveals the true market intent. Psychology shifts from hesitation to action.

Conclusion

Doji candlesticks reflect the inner conflict of the market—a tug-of-war between optimism and fear, bulls and bears, action and hesitation. By understanding the psychology behind Doji formations, traders can better anticipate market behavior and make informed decisions.