Introduction

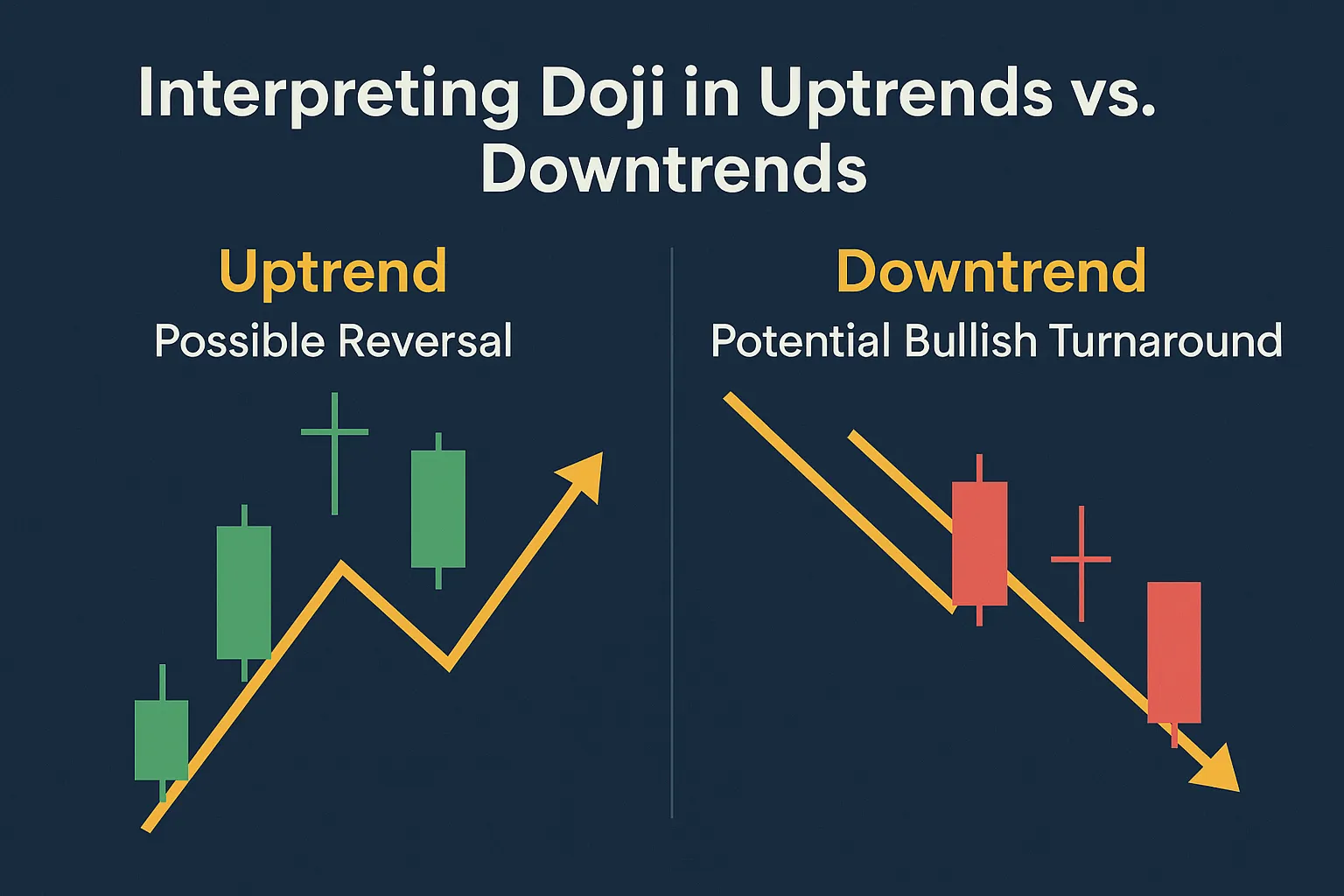

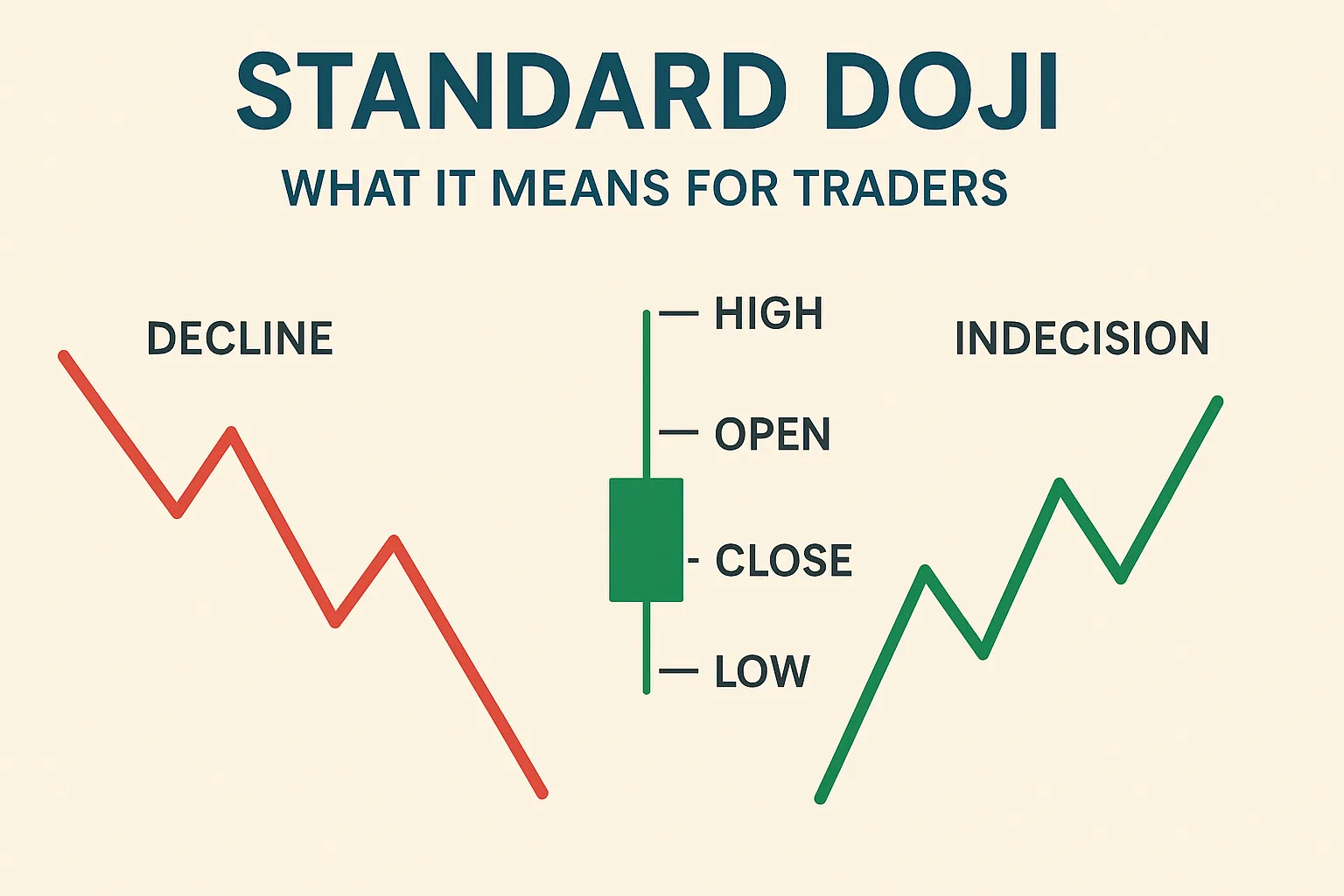

Doji candlesticks are signs of market indecision, but their meaning changes depending on whether the market is in an uptrend or downtrend. This post will explain how to correctly interpret Doji candles based on trend direction.

Doji in an Uptrend: Possible Reversal Signal

- Why It Matters: A Doji after a strong uptrend can show that buyers are losing strength.

- Key Sign: When a Doji appears at a resistance level, it can signal a bearish reversal.

- Confirmation: Wait for a bearish candle next to confirm the shift.

Doji in a Downtrend: Potential Bullish Turnaround

- Market Psychology: After heavy selling, a Doji indicates sellers are exhausted.

- Support Levels: A Doji near support may hint at an upcoming bullish reversal.

- Confirmation: A bullish candle after the Doji helps confirm the rebound.

When Doji Signals Continuation

- Sometimes, a Doji just marks a pause, especially in strong trends.

- Look for volume and momentum indicators to decide if the trend will resume.

Conclusion

Understanding how to interpret Doji candles based on market trends improves your trading decisions. Always combine trend analysis with Doji patterns for the best results.