Introduction

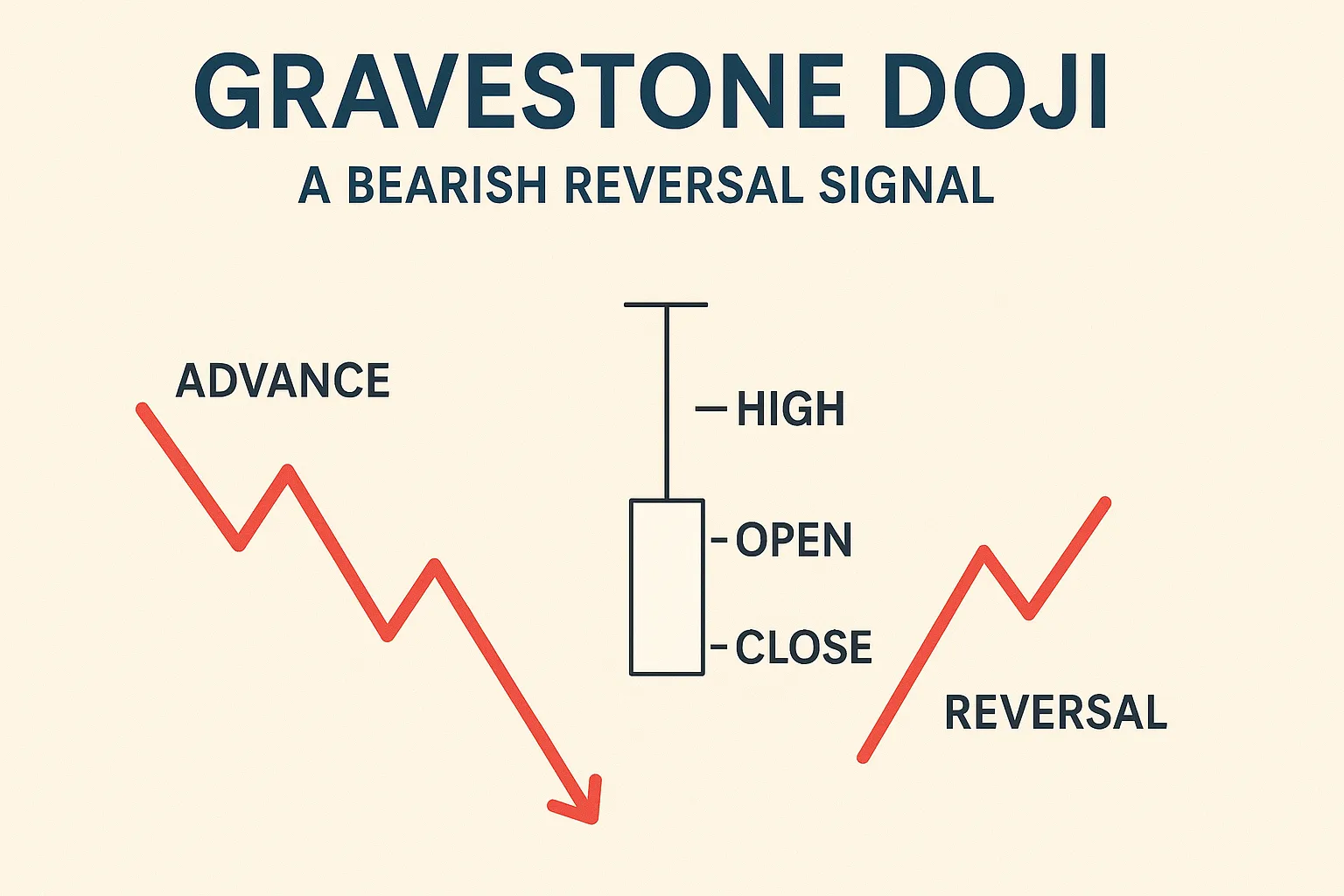

The Gravestone Doji is a powerful bearish reversal candlestick pattern that often appears at the top of an uptrend. It reflects a shift in market sentiment, where buyers lose control and sellers start to dominate. Recognizing this pattern early can help traders exit long positions or prepare for short opportunities.

What is a Gravestone Doji?

- Appearance: A candle with a long upper wick, little to no lower wick, and open/close at or near the low of the session.

- Psychology: Buyers pushed prices higher, but sellers reversed the gains, closing the price back near the open.

- Signal: Potential trend reversal from bullish to bearish.

When Does the Gravestone Doji Appear?

- Commonly seen at the end of an uptrend or near resistance levels.

- Often followed by a bearish confirmation candle (strong red candle).

How to Trade the Gravestone Doji

- Wait for Confirmation: Don’t trade the Doji alone. Look for a bearish candle that confirms the reversal.

- Set Entry Points: Enter a short trade below the low of the Gravestone Doji.

- Stop-Loss: Place above the high of the Gravestone Doji.

- Targets: Look for support zones or use risk-reward ratios (e.g., 1:2).

Example Scenario

- A stock rises steadily and forms a Gravestone Doji at a key resistance level.

- The next day, a strong bearish candle forms, confirming the reversal.

- Traders enter short, targeting a move down to the next support.

Frequently Asked Questions (FAQs)

1. Is the Gravestone Doji always bearish?

Yes, it is generally considered a bearish reversal pattern, especially when confirmed by further bearish price action.

2. Can the Gravestone Doji appear in downtrends?

It can, but it’s more reliable at the top of an uptrend. In downtrends, it may signal a continuation rather than a reversal.

3. How accurate is the Gravestone Doji?

Its accuracy increases with:

- Volume confirmation.

- Appearance at key resistance levels.

- A strong follow-up bearish candle.

4. What time frames work best for Gravestone Doji?

Higher time frames like 1-hour, 4-hour, or daily charts tend to provide more reliable signals.

5. What’s the difference between Gravestone Doji and Shooting Star?

Both are bearish, but:

- Gravestone Doji: Open and close are nearly the same at the low.

- Shooting Star: Has a small real body near the low with a long upper wick.

Conclusion

The Gravestone Doji is a crucial pattern for traders seeking to identify potential market tops. When combined with confirmation, it offers a high-probability bearish reversal signal, helping traders manage risk and maximize gains.