Introduction

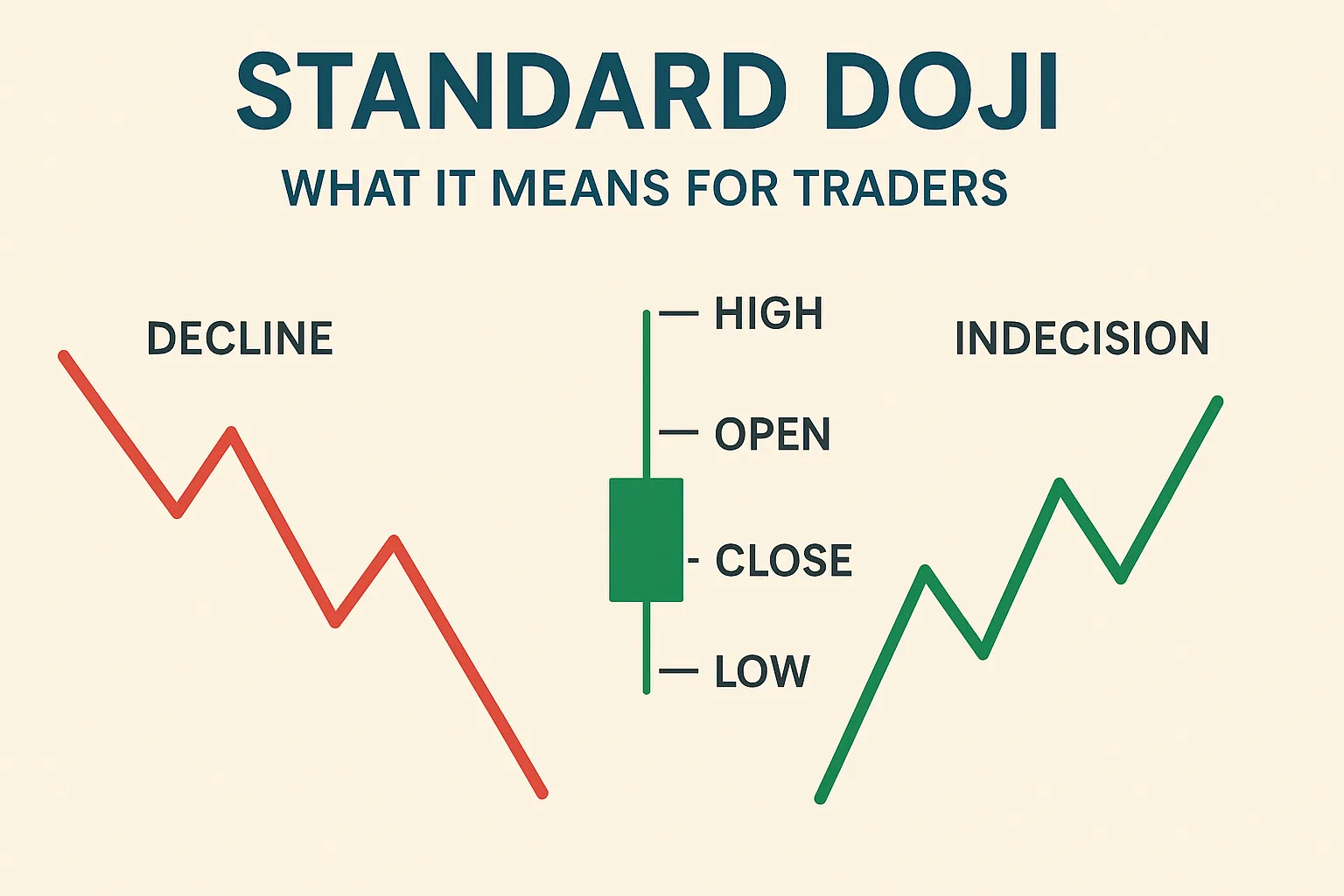

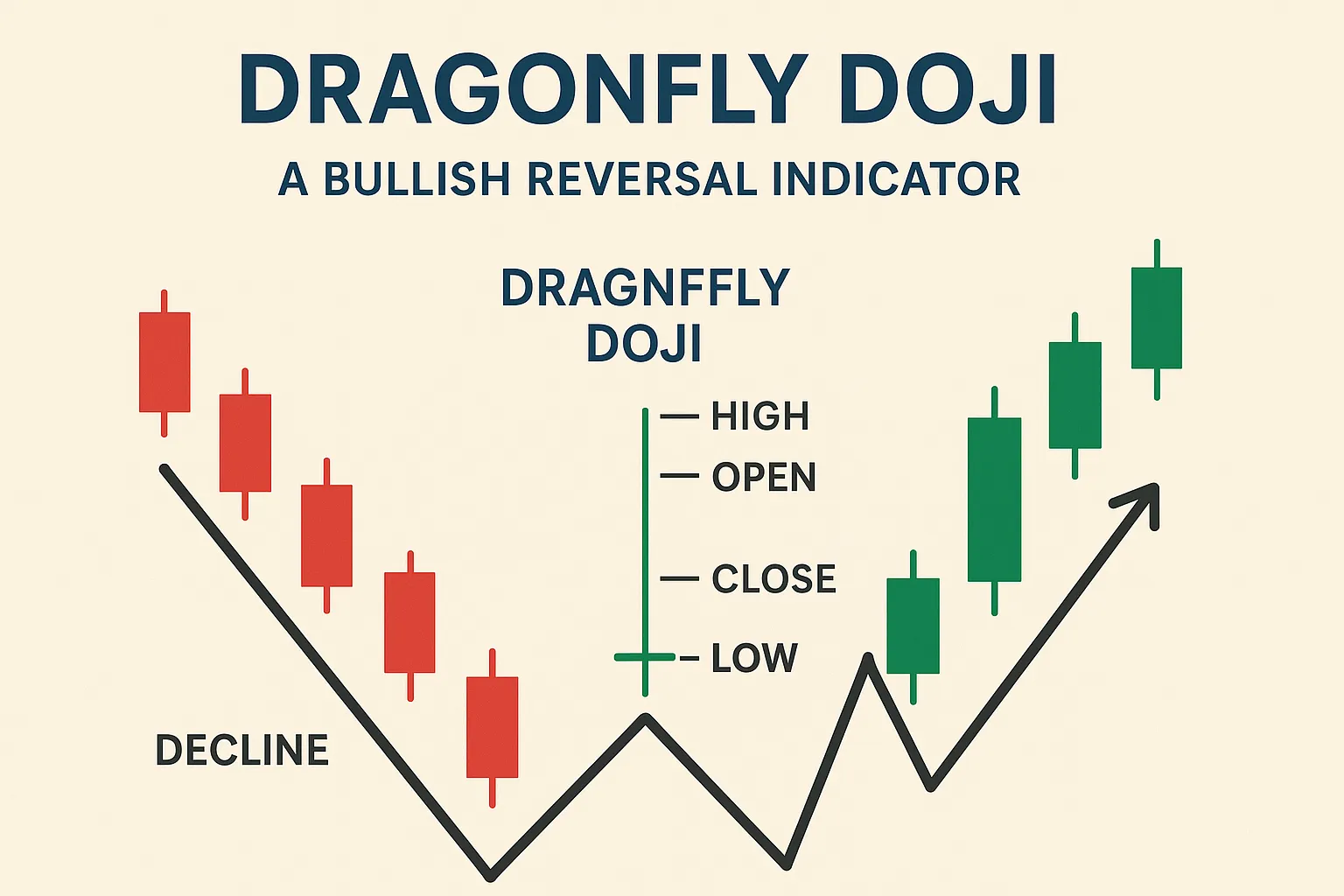

Doji candlestick patterns are powerful tools for identifying market indecision. While they don’t signal trades on their own, when combined with other tools and strategies, Doji candles can help you enter high-probability trades. This guide covers top trading strategies to use with Doji patterns.

Top 5 Trading Strategies Using Doji Candles

1. Support and Resistance Reversal Strategy

- Setup: Identify a Doji at a strong support or resistance level.

- Execution: Wait for a confirmation candle (bullish at support, bearish at resistance).

- Entry: Place trade after confirmation.

- Stop-Loss: Just below/above the Doji’s wick.

- Why it works: Markets often reverse at key levels when indecision appears.

2. Doji + Moving Average Crossover Strategy

- Setup: Spot a Doji near a 50 MA or 200 MA.

- Execution: Wait for the price to bounce off or cross the MA with confirmation.

- Entry: After the confirmation candle breaks the MA direction.

- Stop-Loss: Beyond the Doji wick.

- Why it works: Combines trend strength with indecision resolution.

3. Doji with RSI (Relative Strength Index)

- Setup: Look for a Doji when RSI is in overbought (>70) or oversold (<30) zones.

- Execution: Use RSI + Doji to anticipate reversals.

- Entry: After confirmation candle aligned with RSI signal.

- Stop-Loss: Use Doji wicks as range.

- Why it works: Doji + extreme RSI shows possible market turning points.

4. Trend Continuation Strategy

- Setup: A Doji forms within an existing strong trend.

- Execution: Use Doji as a pause in trend; wait for trend resumption confirmation.

- Entry: With the trend, after confirmation.

- Stop-Loss: Opposite side of Doji wick.

- Why it works: Trends often continue after short indecision periods.

5. Breakout Strategy with Doji

- Setup: Doji forms during consolidation or range.

- Execution: Wait for breakout above/below range with strong volume.

- Entry: After breakout confirmation.

- Stop-Loss: Inside the previous range.

- Why it works: Doji signals market tension ready for breakout.

Doji Trading Tips

- Always use confirmation—never trade based on Doji alone.

- Combine with volume analysis—high volume increases Doji’s impact.

- Prefer higher time frames (4H, daily) for stronger signals.

- Adapt your risk-reward to market volatility.

Conclusion

Doji candlestick patterns offer versatile opportunities when paired with strong technical setups. Whether trading reversals, continuations, or breakouts, understanding how to use Doji candles within a broader strategy helps you enter the market with more confidence and control.