Introduction

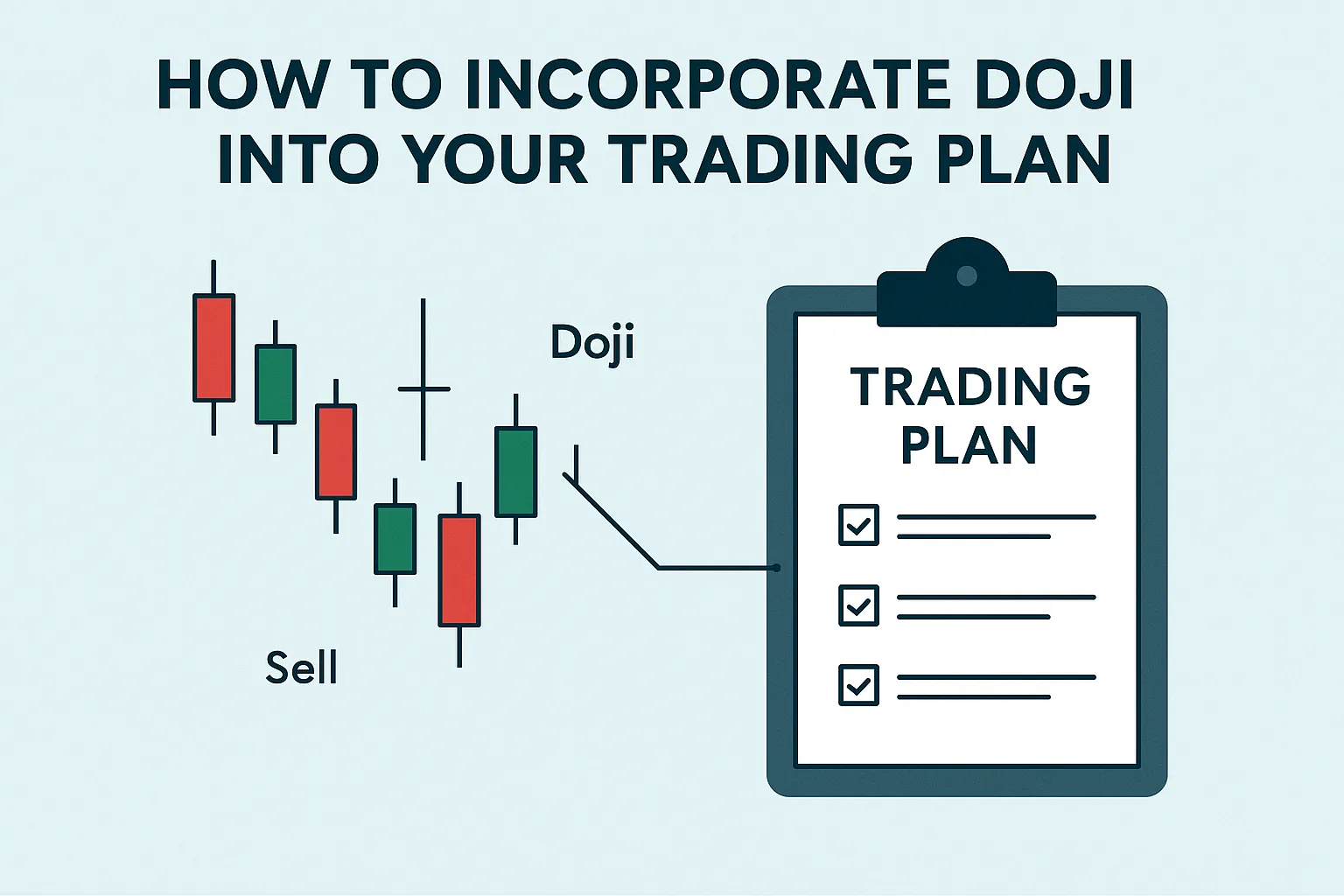

The Doji candlestick pattern is a valuable tool for traders, but it becomes truly powerful when combined with a solid trading plan. This guide will show you how to integrate Doji patterns into your trading decisions for better timing and risk management.

Step 1: Understand When to Use Doji Patterns

- Use Doji patterns in trending markets to spot potential reversals.

- Ideal at support/resistance levels or key psychological zones.

Step 2: Combine Doji with Other Indicators

- Volume: High volume confirms the Doji’s importance.

- RSI/Stochastic: Overbought/oversold conditions strengthen signals.

- Moving Averages: Use for trend confirmation.

Step 3: Define Entry and Exit Rules

- Entry: Wait for a confirmation candle after the Doji.

- Stop-Loss: Place below/above the Doji’s wick depending on the trade direction.

- Take-Profit: Use risk-reward ratio of at least 1:2.

Step 4: Time Frame Selection

- Best results on 1-hour, 4-hour, or daily charts.

- Avoid overtrading Doji patterns on lower time frames.

Step 5: Backtest and Adjust

- Backtest Doji setups using historical charts.

- Adjust your plan based on real performance and improve your strategy.

Conclusion

Incorporating Doji candlestick patterns into your trading plan enhances your ability to spot market indecision and act decisively. By combining Dojis with indicators, trend analysis, and proper risk management, you build a robust and adaptable trading strategy.