Introduction

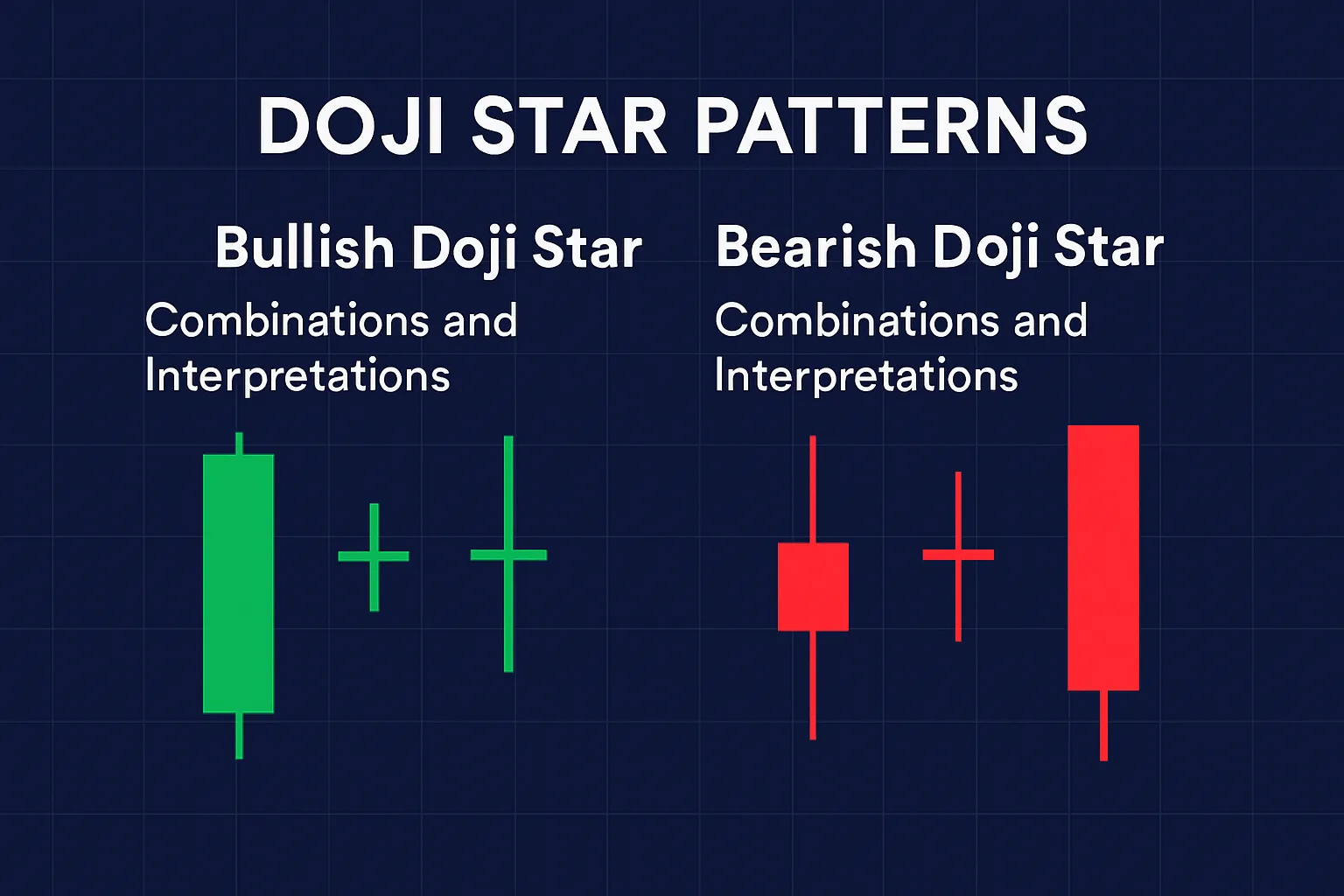

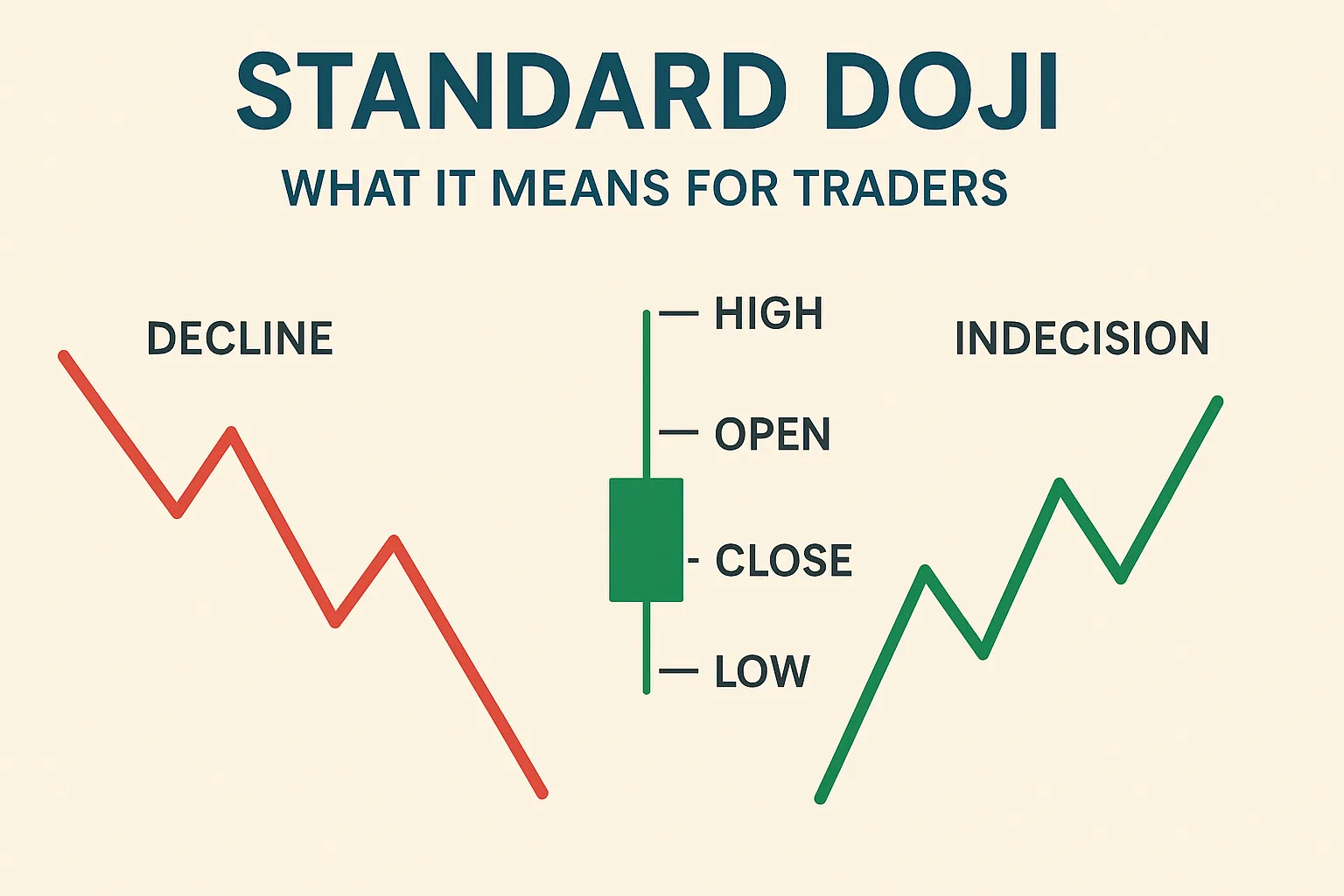

Doji Star patterns are multi-candle formations that include a Doji as part of a larger reversal pattern. These combinations are widely used by traders to spot market turning points. Understanding how to identify and interpret these patterns helps you anticipate major trend reversals.

Key Doji Star Patterns

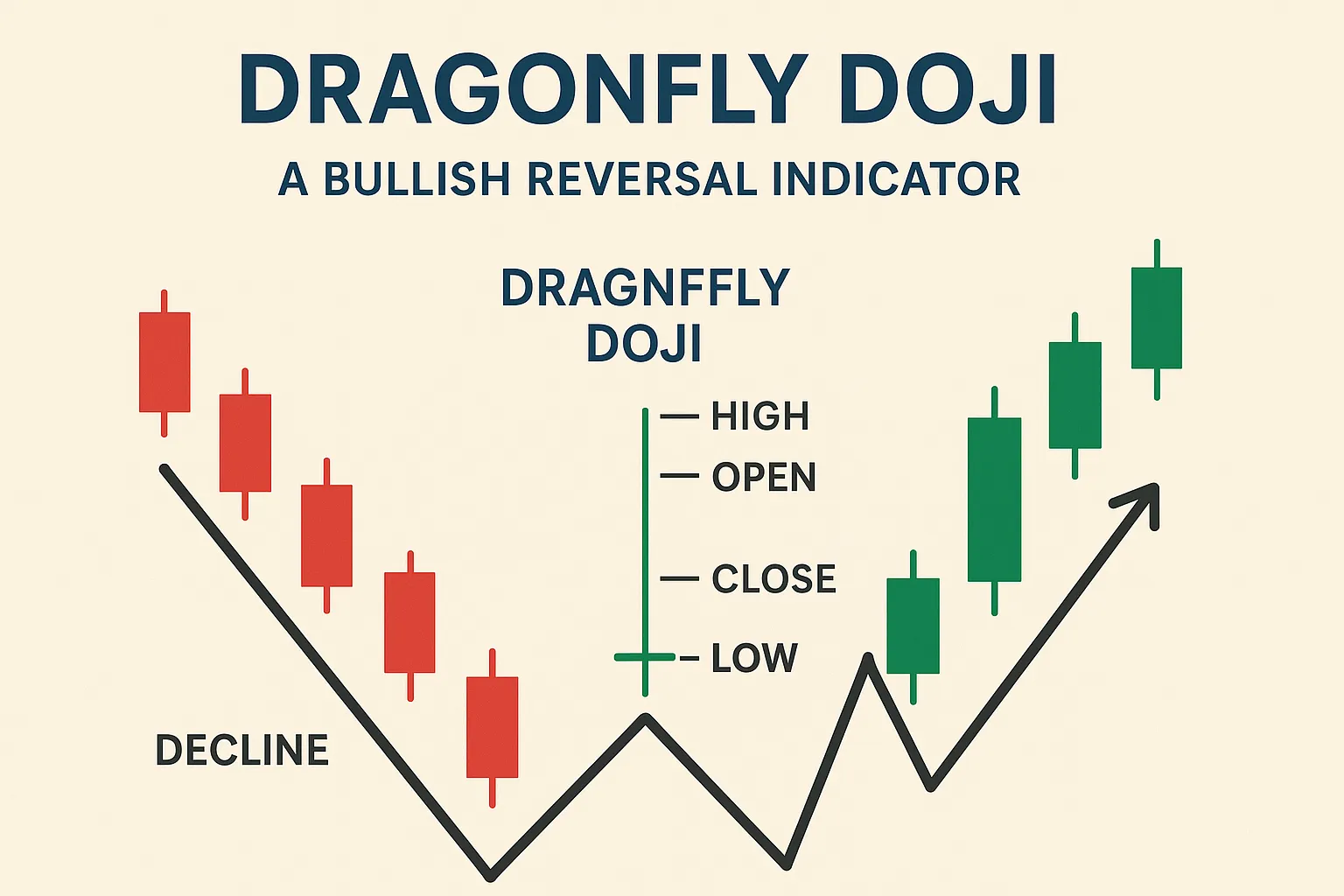

1. Morning Star Doji (Bullish Reversal)

- Structure:

- Candle 1: Long bearish candle.

- Candle 2: Doji indicating indecision.

- Candle 3: Strong bullish candle closing above the midpoint of Candle 1.

- Signal: Marks the end of a downtrend and potential bullish reversal.

- Best Use: At support levels after a prolonged downtrend.

2. Evening Star Doji (Bearish Reversal)

- Structure:

- Candle 1: Long bullish candle.

- Candle 2: Doji showing hesitation.

- Candle 3: Strong bearish candle closing below the midpoint of Candle 1.

- Signal: Indicates the end of an uptrend and potential bearish reversal.

- Best Use: Near resistance levels or after strong bullish momentum.

3. Tri-Star Patterns

- Bullish Tri-Star:

- Three Doji candles appear at the bottom of a downtrend.

- Signals a high-probability bullish reversal.

- Bearish Tri-Star:

- Three Doji candles at the top of an uptrend.

- Signals a strong bearish reversal.

- Note: Rare but powerful when confirmed by volume and price action.

4. Doji Star vs. Other Star Patterns

- Doji Star: Contains a Doji in the middle.

- Regular Star Patterns: May have small real bodies instead of a Doji.

- Importance: Doji Stars often indicate stronger indecision and more potential for significant reversals.

How to Trade Doji Star Patterns

- Identify the Pattern: Ensure all elements align (Candle 1, Doji, Candle 3).

- Wait for Confirmation: Trade only after the third candle confirms the reversal.

- Entry Point: Enter trade after the confirmation candle closes.

- Stop-Loss: Place beyond the Doji’s wick.

- Target: Next support/resistance or a favorable risk-reward ratio.

Tips for Better Interpretation

- Volume: High volume on the confirmation candle strengthens the pattern.

- Trend Context: Works best after prolonged trends.

- Time Frames: More reliable on 4-hour and daily charts.

Conclusion

Doji Star patterns are among the most effective reversal signals in candlestick trading. By recognizing combinations like Morning Star Doji and Evening Star Doji, traders can anticipate key turning points in the market and make better-informed trading decisions.