Introduction

Cryptocurrency markets are known for their high volatility, fast price movements, and unpredictable trends. In such environments, candlestick patterns like the Doji play an important role in helping traders identify market indecision and potential reversals. But does the Doji candlestick work the same way in crypto as it does in traditional markets like stocks or forex? Let’s explore the special considerations when trading Doji patterns in cryptocurrencies.

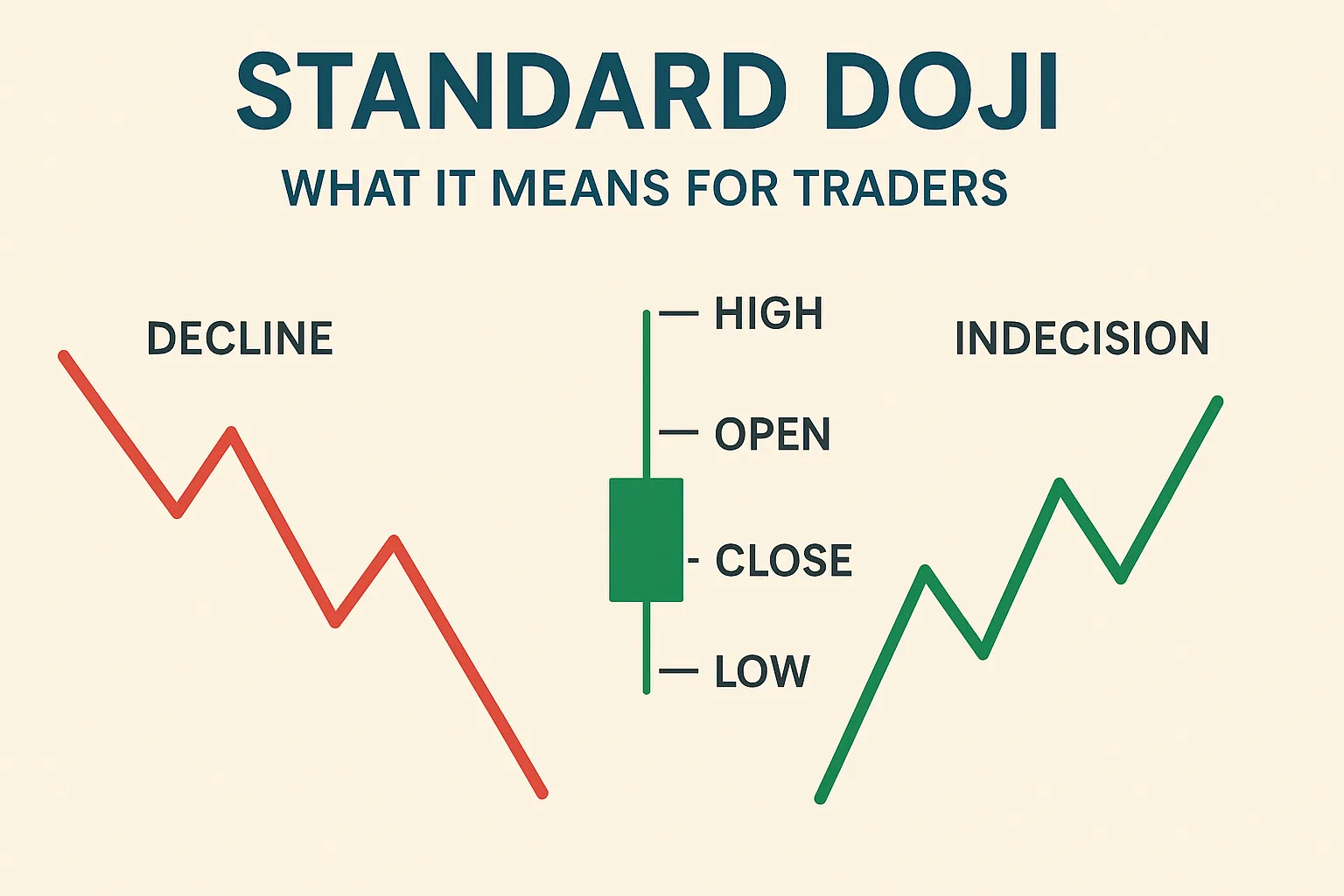

What Is a Doji Candlestick?

A Doji candlestick forms when the opening and closing prices of an asset are nearly the same. It signals a balance between buyers and sellers and is often seen as a sign of market indecision. In crypto markets, this indecision can lead to sharp breakouts or trend continuations, depending on the context.

Why Doji Patterns Are Unique in Crypto Markets

- Higher Volatility

Crypto assets like Bitcoin, Ethereum, or Solana experience larger and quicker price swings. This makes Doji candles appear more frequently, but not all of them carry the same weight as they might in slower markets. - 24/7 Trading

Unlike stocks, crypto markets never close. This continuous trading can cause irregular candlestick formations, including Dojis, especially during low-liquidity periods. - Influence of News & Sentiment

In crypto, news events and social media play a big role. A Doji candle might form due to temporary indecision, but news can quickly push prices in either direction, reducing the reliability of a Doji alone.

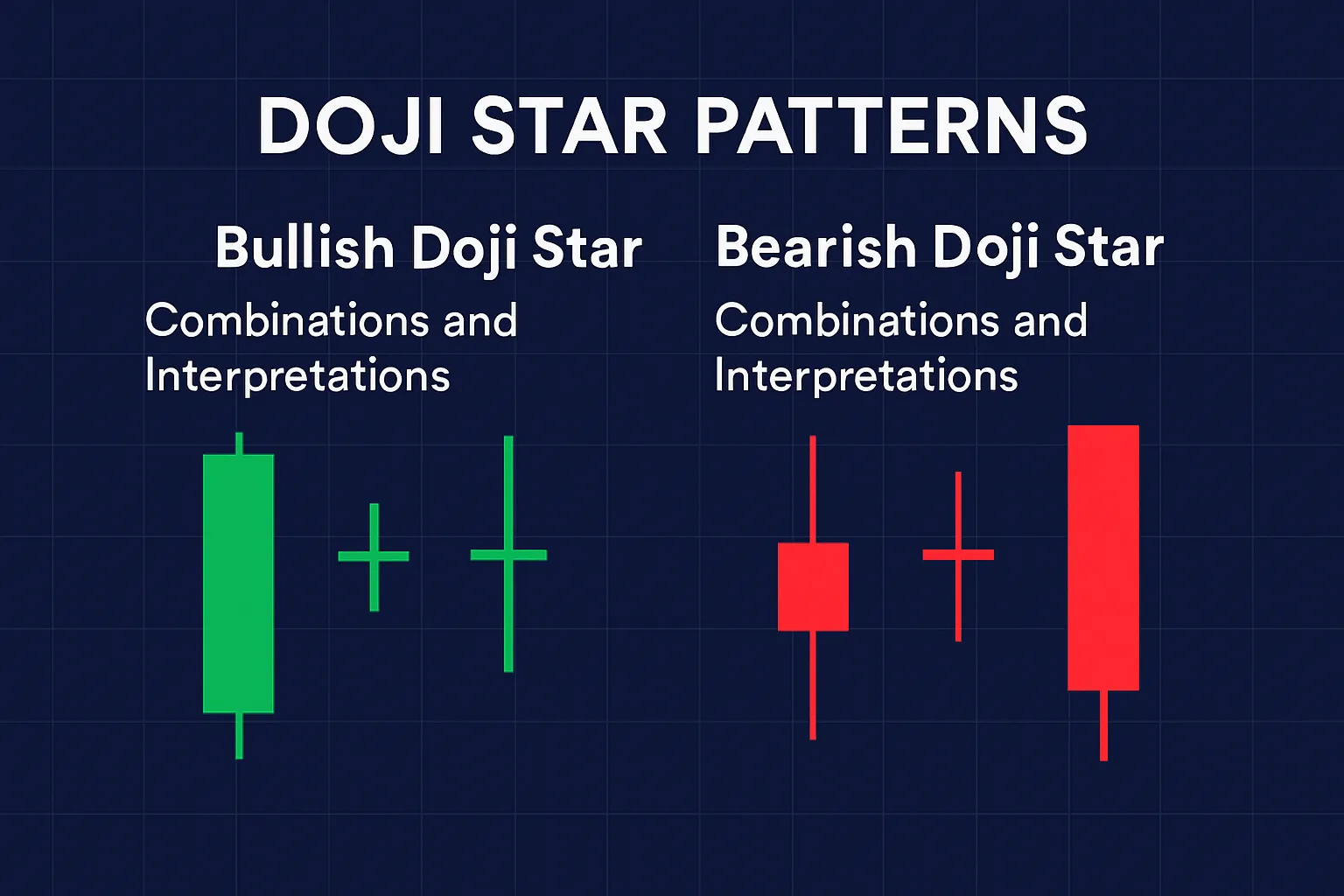

Types of Doji in Crypto Trading

- Gravestone Doji: Signals potential bearish reversal at the top of a rally.

- Dragonfly Doji: Indicates bullish reversal at the bottom of a downtrend.

- Long-Legged Doji: Shows extreme volatility with no clear direction.

How to Trade Doji Candles in Crypto

- Use Confirmation

Never trade based on a Doji alone. Wait for the next candle to confirm the direction—whether it’s a breakout or a reversal. - Combine with Indicators

Use technical indicators like RSI, MACD, or Volume to validate Doji signals. For example, a Doji with oversold RSI might strengthen a bullish bias. - Time Frame Matters

On lower time frames (like 5-min or 15-min charts), Doji patterns can be noise. They are more reliable on 1-hour or daily charts in crypto. - Focus on Key Levels

Pay attention to support and resistance levels. A Doji near a major support zone could indicate a strong reversal opportunity.

Special Tips for Crypto Traders

- Always set stop-loss orders due to the rapid and unpredictable nature of crypto.

- Watch out for fakeouts after a Doji forms, especially in low-volume conditions.

- Use trend analysis to determine whether to expect continuation or reversal after a Doji.

Conclusion

While the Doji candlestick pattern remains a valuable tool for crypto traders, its effectiveness depends on market context, confirmation, and volatility conditions. By understanding the special considerations in crypto markets, traders can use Doji patterns more effectively and make better-informed trading decisions.