Introduction of Doji Case Studies

Doji candlesticks are powerful indicators of market indecision, often leading to significant price moves when correctly interpreted. In this post, we’ll explore real-world examples of Doji formations that led to trend reversals or continuations in different markets, including stocks, forex, and cryptocurrency.

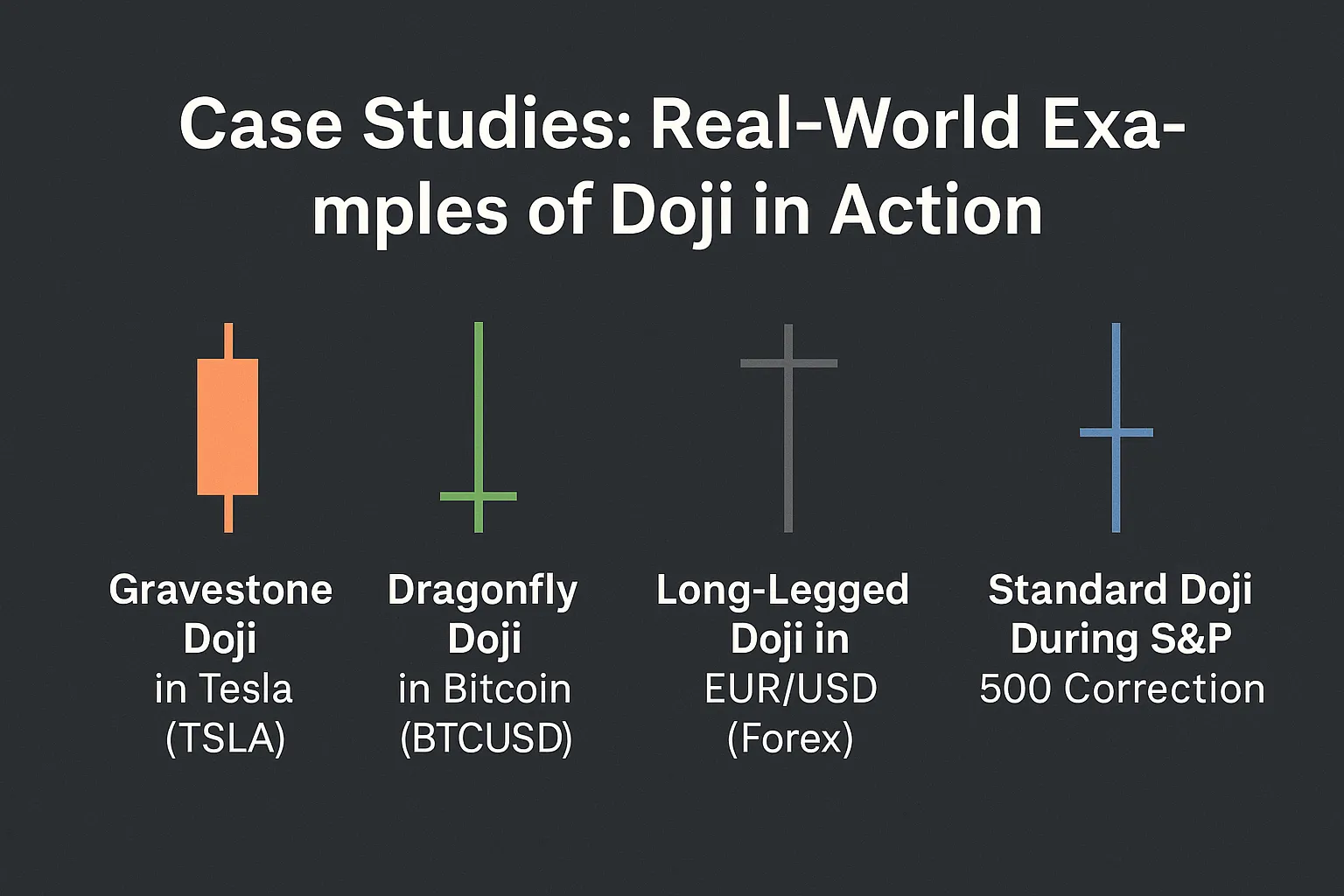

Case Study 1: Gravestone Doji Case Studies in Tesla (TSLA)

- Scenario: In early 2022, after a strong bullish rally, TSLA formed a Gravestone Doji on the daily chart.

- Outcome: This Doji at the top of the trend signalled a bearish reversal. The stock dropped over 15% in the following days.

- Key Insight: The Gravestone Doji was confirmed by a high-volume bearish candle the next day, validating the reversal.

Case Study 2: Dragonfly Doji Case Studies in Bitcoin (BTCUSD)

- Scenario: Bitcoin formed a Dragonfly Doji on the 4-hour chart after a sharp decline in mid-2021.

- Outcome: The Doji appeared at a key support level, and BTC rebounded, rallying over 8% in the next 12 hours.

- Key Insight: The Dragonfly Doji, combined with strong support, provided a high-probability bullish setup.

Case Study 3: Long-Legged Doji in EUR/USD (Forex)

- Scenario: EUR/USD formed a Long-Legged Doji during a period of high volatility after ECB announcements.

- Outcome: The market showed indecision but eventually broke out upwards by 100 pips.

- Key Insight: The breakout direction was confirmed by RSI divergence, emphasizing the need for confirmation.

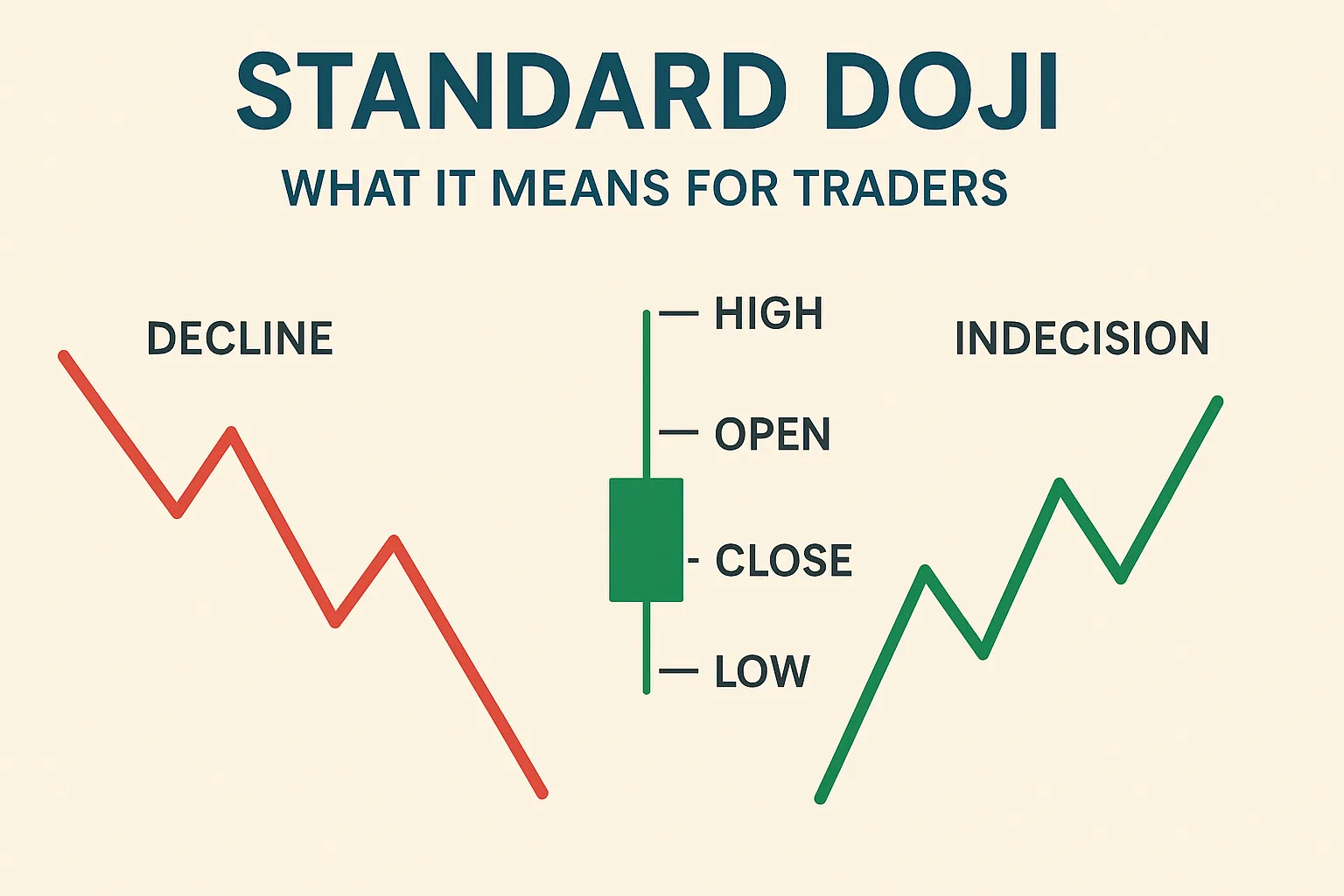

Case Study 4: Standard Doji During S&P 500 Correction

- Scenario: The S&P 500 formed a Standard Doji during a market correction in late 2020.

- Outcome: After the Doji, the market continued its correction for another 5% drop.

- Key Insight: Not all Dojis signal reversal—this one signaled a pause, then continuation.

Lessons from Real-World Doji Setups

- Context Matters: Dojis at support/resistance are more reliable.

- Confirmation Is Key: Wait for next candle or volume spikes.

- Type of Doji: Understand whether it’s Gravestone, Dragonfly, or Long-Legged.

- Time Frame Sensitivity: Higher time frames often produce stronger signals.

Conclusion

These real-world examples show how powerful Doji candlesticks can be when used correctly. Whether signaling a reversal or continuation, understanding their context and combining them with other tools can improve your trading success.