Introduction

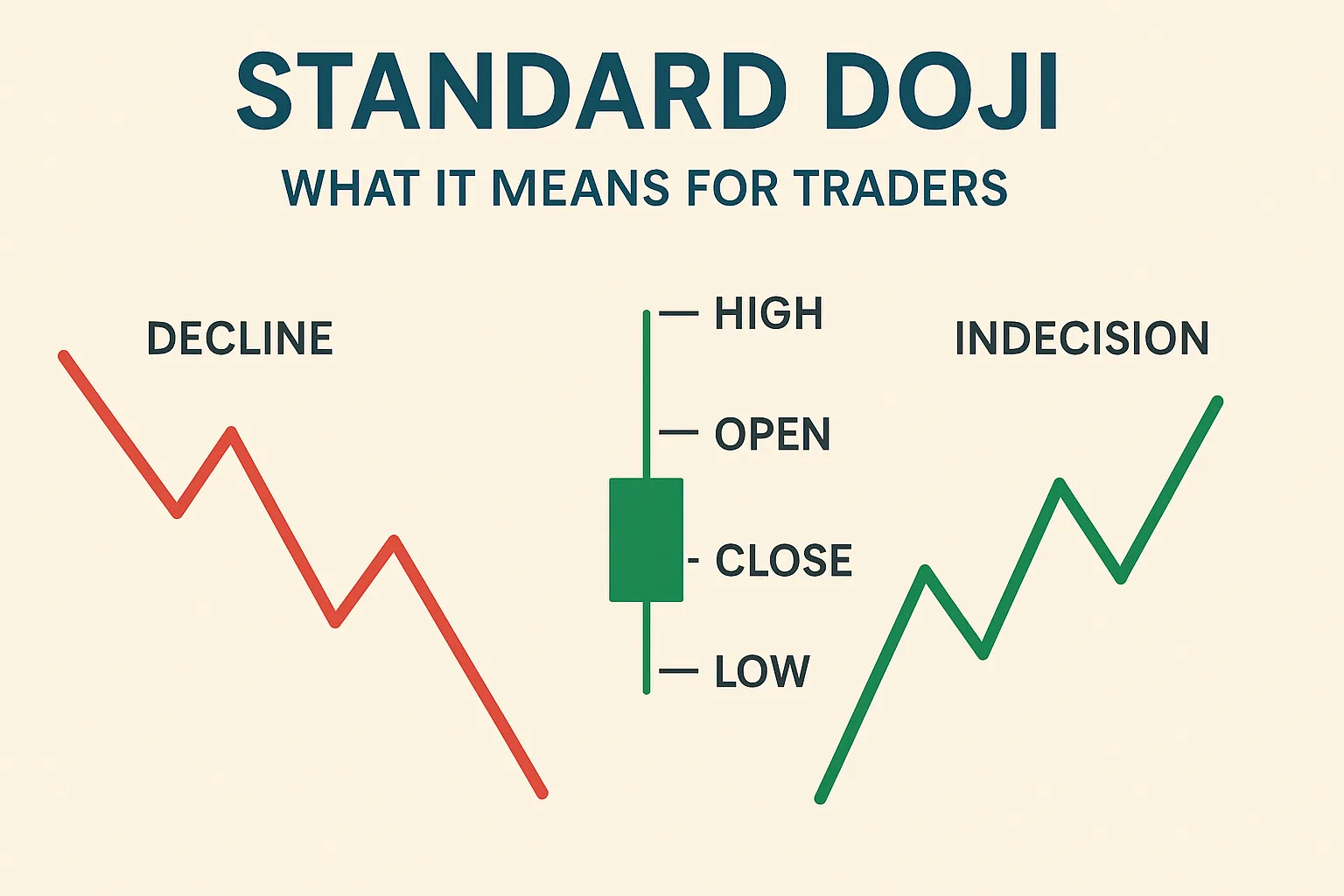

The Doji candlestick is a powerful tool, often signalling indecision or potential reversals. However, many traders misinterpret Doji patterns and make costly mistakes when trading them. This post will guide you through the most common errors and how to avoid them, ensuring you trade Doji formations with more confidence and accuracy without Mistakes when Trading Doji Patterns.

Mistake #1: Trading Doji Without Confirmation

Many beginners act on a Doji without waiting for the next candle to confirm direction. Common Mistakes Trading Doji Patterns include not waiting for confirmation after observing a Doji. A Doji alone only shows indecision—it doesn’t predict what comes next. Always wait for the next price action for confirmation.

Mistake #2: Ignoring Market Context

A Doji’s meaning changes depending on where it appears:

- At support/resistance? It might indicate a reversal.

- In the middle of a trend? It could signal a pause. Never analyze a Doji in isolation—consider the overall trend. Those are key elements to remember to avoid Mistakes Trading Doji Patterns.

Mistake #3: Overtrading Small Time Frames

On low time frames (1-min, 5-min), Dojis are common and often meaningless. Trading every Doji here leads to false signals. Focus on higher time frames like 1-hour or daily for more reliable patterns to overcome Mistakes Trading Doji Patterns.

Mistake #4: Ignoring Volume

Volume confirms the strength of a Doji:

- Low volume = weak signal.

- High volume = strong indication of a shift. Ignoring volume can lead to misjudging the importance of the Doji and committing Mistakes Trading Doji Patterns.

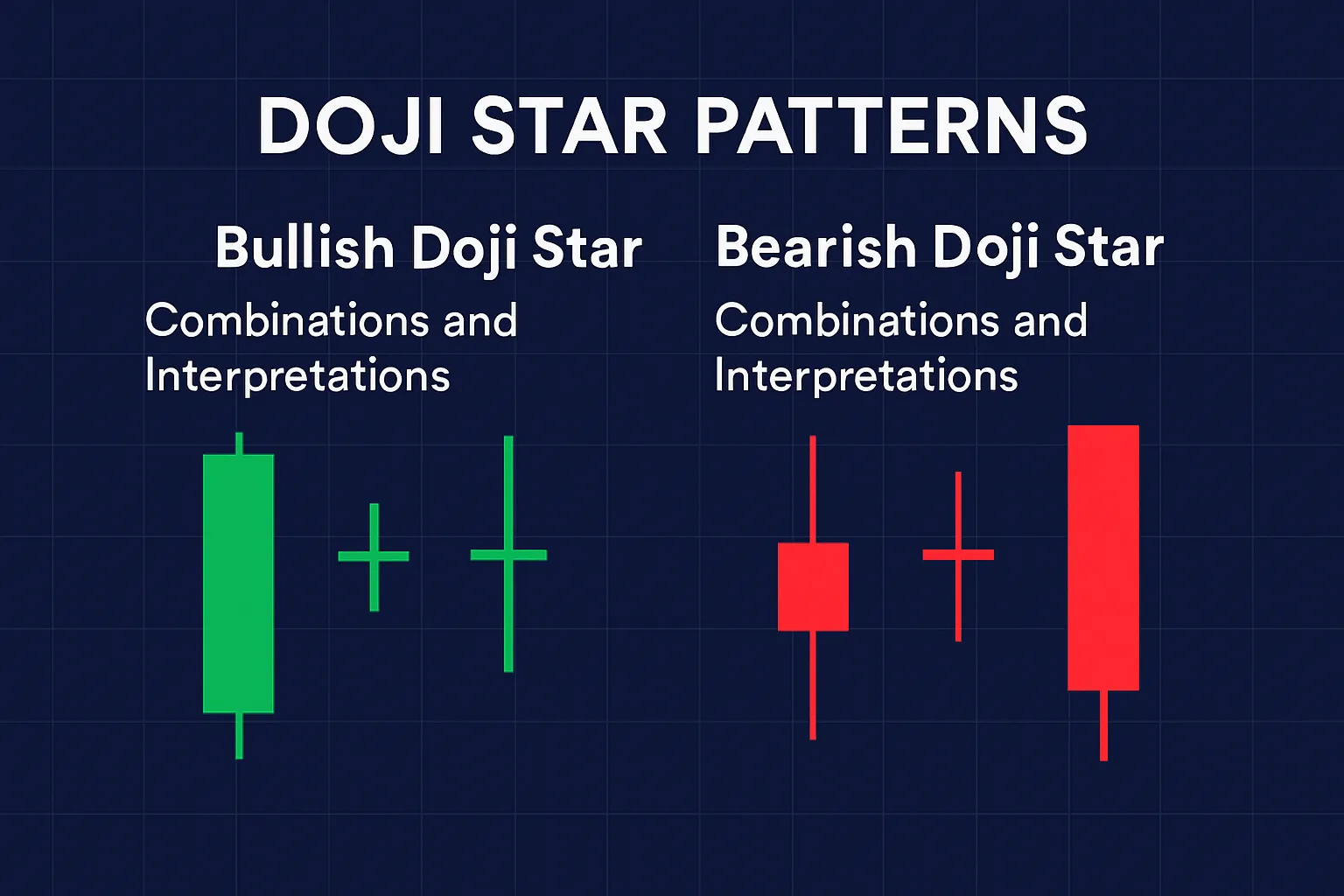

Mistake #5: Misunderstanding Different Doji Types

Not all Dojis are the same:

- Gravestone Doji: Bearish potential.

- Dragonfly Doji: Bullish potential.

- Long-Legged Doji: High volatility, uncertain direction. Understand the specific type of Doji you’re trading is crucial to avoid Mistakes Trading Doji Patterns.

Mistake #6: Setting Tight Stop-Losses

Due to market volatility, especially in crypto or forex, tight stop-losses near a Doji pattern often result in premature exits. Give the market room to breathe after a Doji to minimise Mistakes Trading Doji Patterns.

Conclusion

Avoiding these common mistakes can improve your Doji trading strategy significantly. Remember, the Doji is a signal of indecision, not an immediate buy or sell command. By trading with patience, using confirmation, and understanding context, you can make better-informed decisions and reduce Mistakes Trading Doji Patterns.