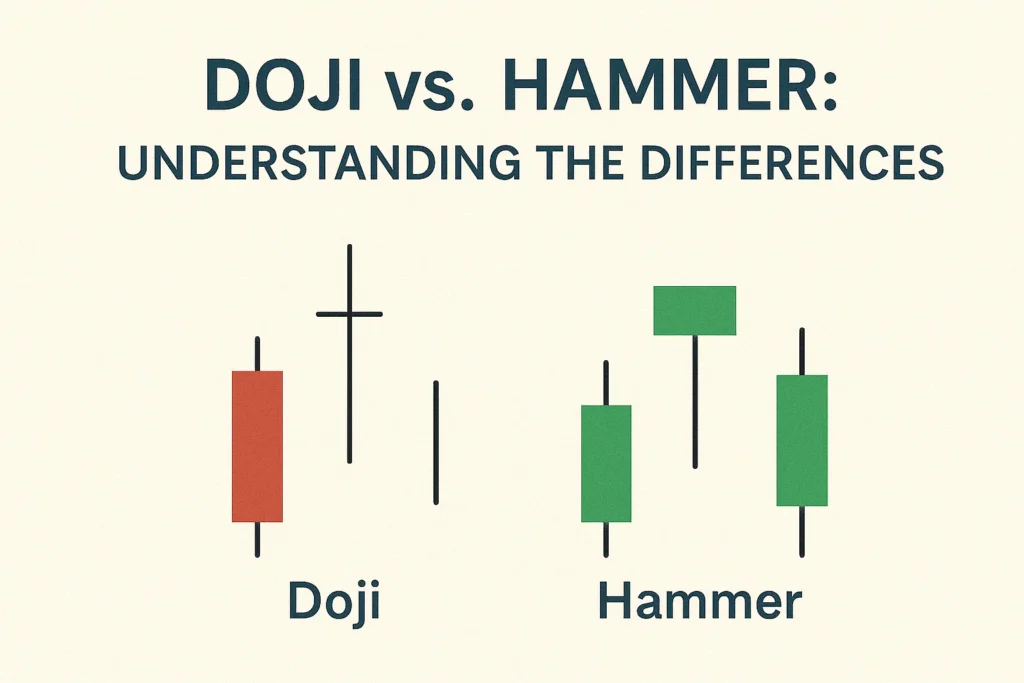

Doji vs. Hammer: Understanding the Differences

ntroductionBoth Doji and Hammer candlesticks are used to spot potential market reversals, but they have distinct formations and meanings. Misunderstanding the difference can lead to poor trading decisions. Let’s explore how these patterns differ and how to use them effectively. 1. Doji Candlestick: Indecision in the Market 2. Hammer Candlestick: Bullish Reversal Signal Key Differences […]

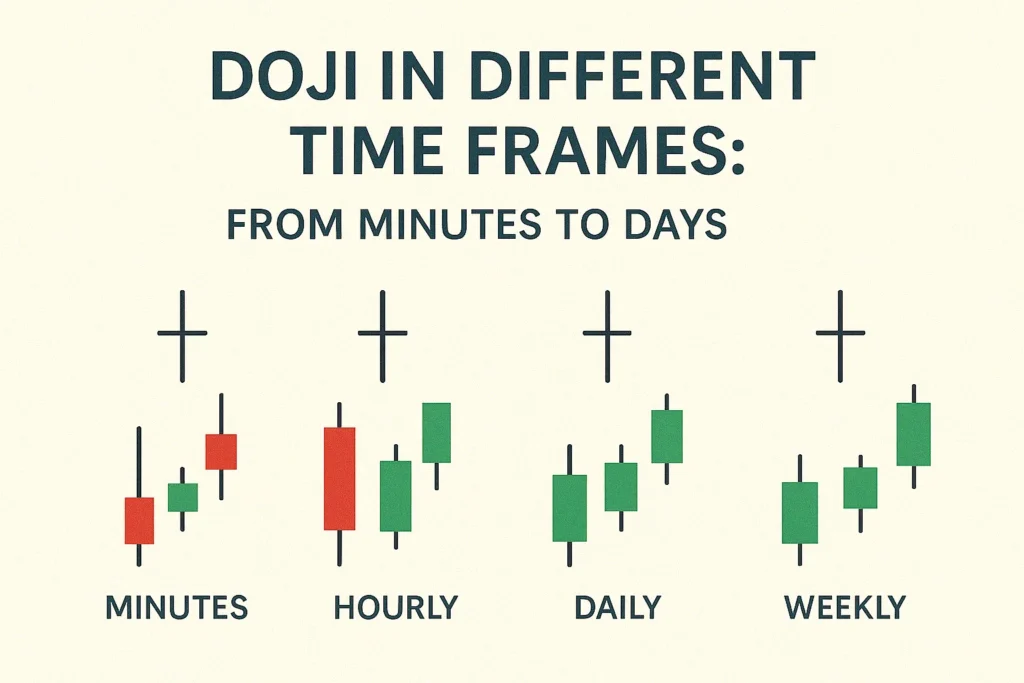

Doji in Different Time Frames: From Minutes to Days

IntroductionThe effectiveness of Doji candlesticks varies greatly depending on the time frame you’re trading. While a Doji on a daily chart may signal a significant shift, the same pattern on a 1-minute chart might be irrelevant noise. This guide explores how to interpret Doji formations across different time frames. 1. Doji on Lower Time Frames […]

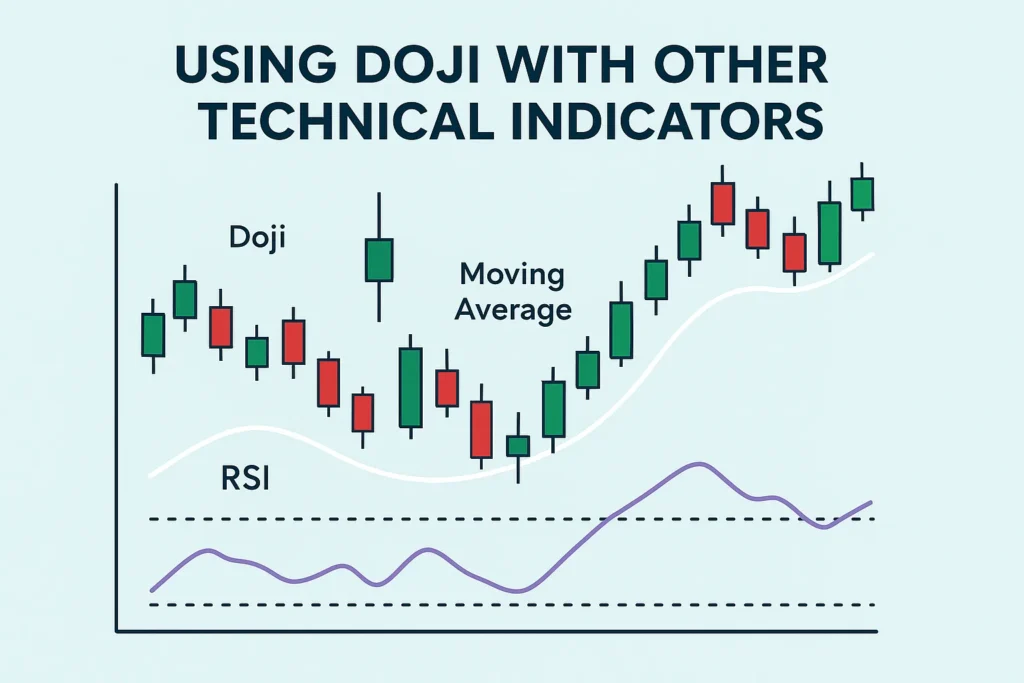

Using Doji with Other Technical Indicators

IntroductionDoji candlestick patterns are strong signals of market indecision, but when used alone, they can lead to false entries. To increase their effectiveness, it’s essential to combine Doji with reliable technical indicators. This post will show you how to do just that. 1. Doji + RSI (Relative Strength Index) 2. Doji + MACD (Moving Average […]

How to Incorporate Doji into Your Trading Plan

IntroductionThe Doji candlestick pattern is a valuable tool for traders, but it becomes truly powerful when combined with a solid trading plan. This guide will show you how to integrate Doji patterns into your trading decisions for better timing and risk management. Step 1: Understand When to Use Doji Patterns Step 2: Combine Doji with […]

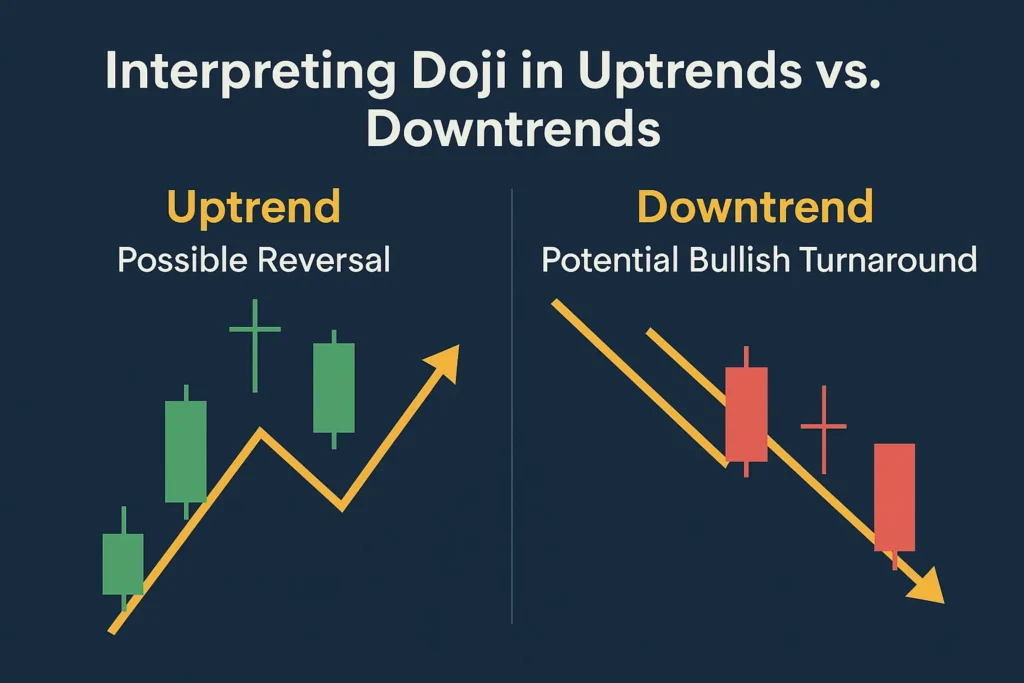

Interpreting Doji in Uptrends vs. Downtrends

IntroductionDoji candlesticks are signs of market indecision, but their meaning changes depending on whether the market is in an uptrend or downtrend. This post will explain how to correctly interpret Doji candles based on trend direction. Doji in an Uptrend: Possible Reversal Signal Doji in a Downtrend: Potential Bullish Turnaround When Doji Signals Continuation Conclusion […]

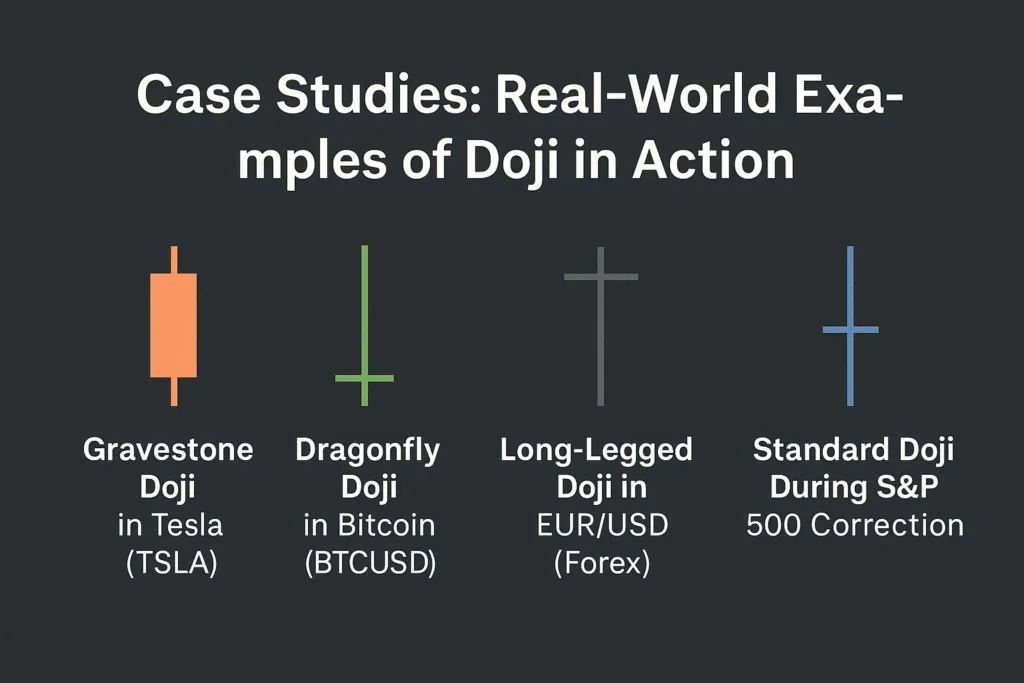

Case Studies: Real-World Examples of Doji in Action

Introduction of Doji Case Studies Doji candlesticks are powerful indicators of market indecision, often leading to significant price moves when correctly interpreted. In this post, we’ll explore real-world examples of Doji formations that led to trend reversals or continuations in different markets, including stocks, forex, and cryptocurrency. Case Study 1: Gravestone Doji Case Studies in […]

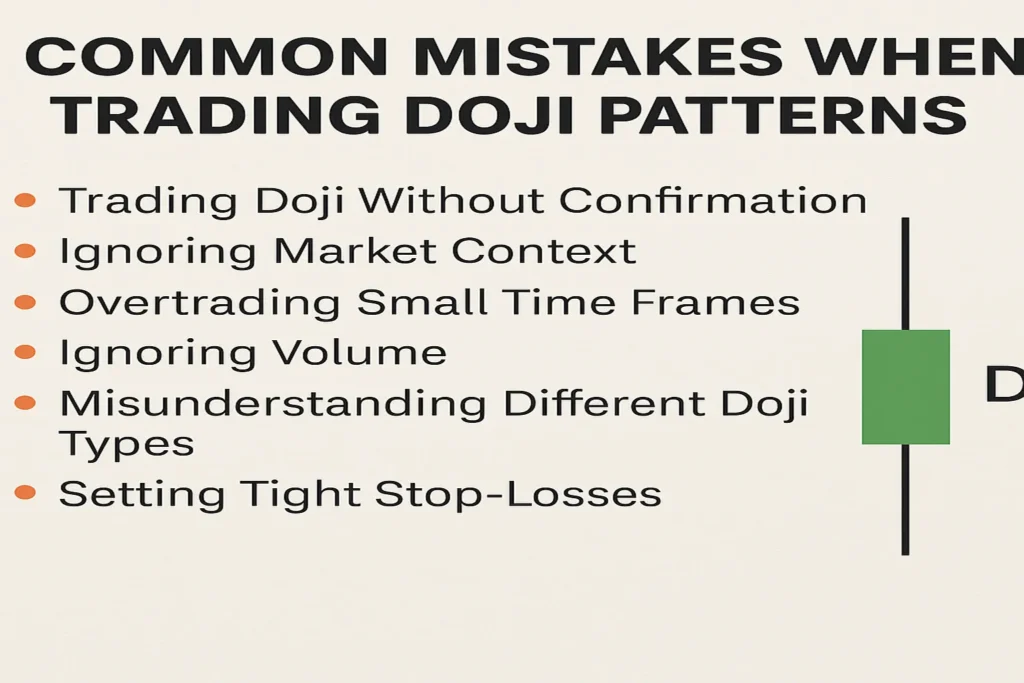

Common Mistakes When Trading Doji Patterns

IntroductionThe Doji candlestick is a powerful tool, often signalling indecision or potential reversals. However, many traders misinterpret Doji patterns and make costly mistakes when trading them. This post will guide you through the most common errors and how to avoid them, ensuring you trade Doji formations with more confidence and accuracy without Mistakes when Trading […]

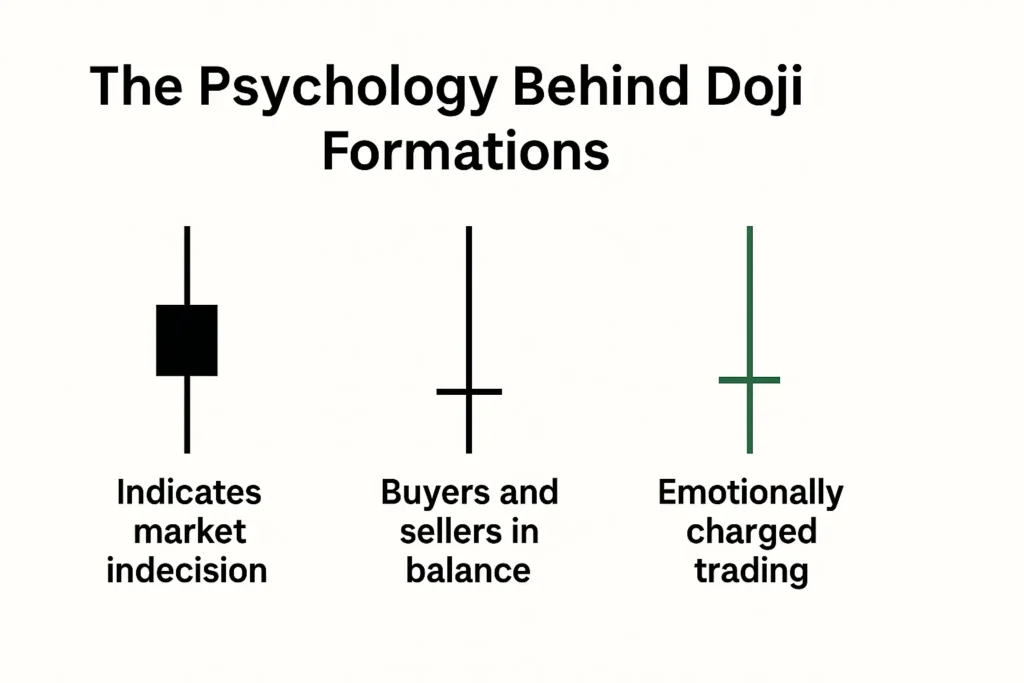

The Psychology Behind Doji Formations

IntroductionCandlestick patterns are not just visual tools—they reflect the emotions and psychology of market participants. Among these, the Doji candlestick stands out as a powerful symbol of indecision. To fully understand the significance of Doji patterns, traders must look beyond the chart and into the psychological battle taking place between buyers and sellers. What Is […]

Doji in Cryptocurrency Markets: Special Considerations

IntroductionCryptocurrency markets are known for their high volatility, fast price movements, and unpredictable trends. In such environments, candlestick patterns like the Doji play an important role in helping traders identify market indecision and potential reversals. But does the Doji candlestick work the same way in crypto as it does in traditional markets like stocks or […]