Introduction

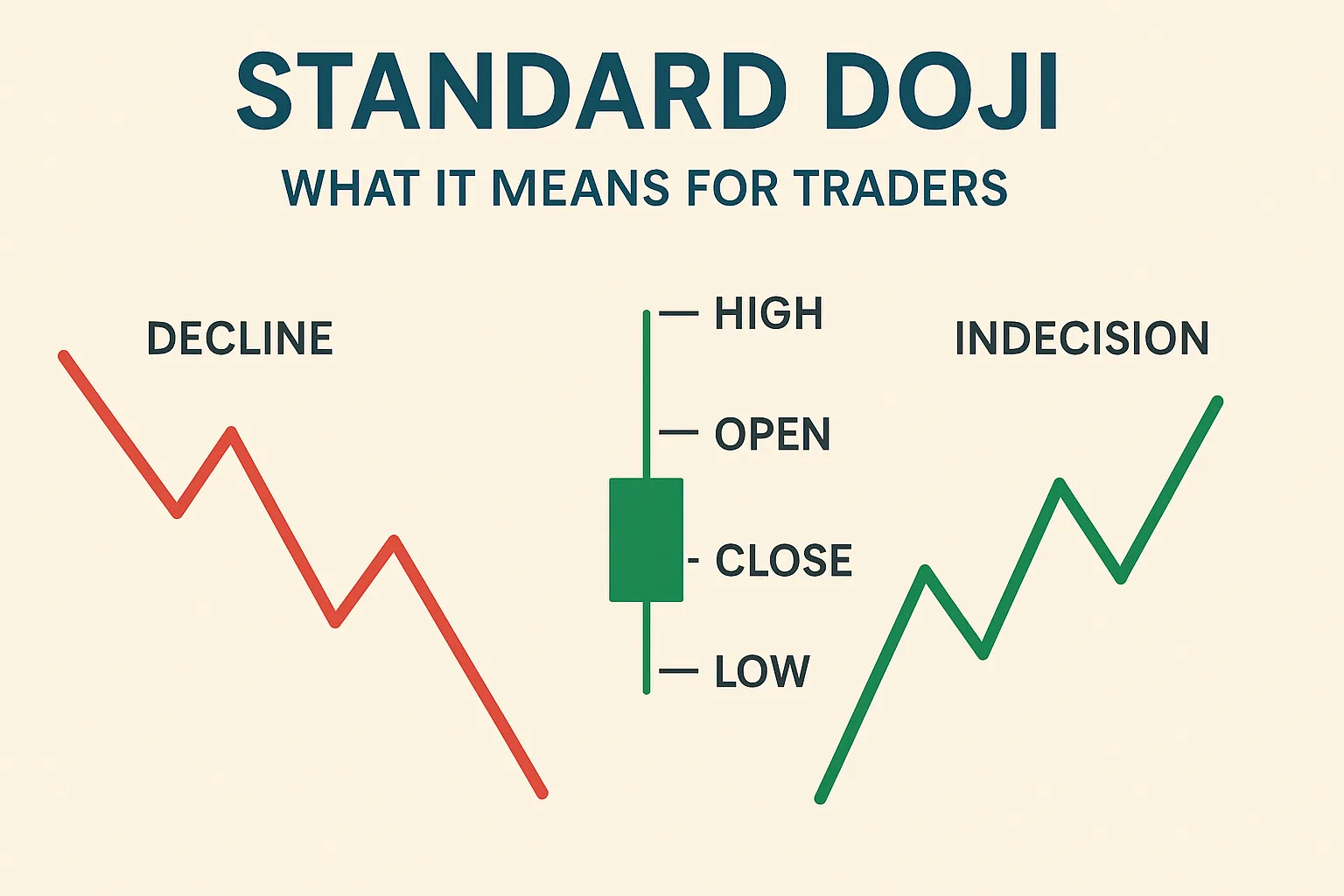

Doji candlestick patterns are strong signals of market indecision, but when used alone, they can lead to false entries. To increase their effectiveness, it’s essential to combine Doji with reliable technical indicators. This post will show you how to do just that.

1. Doji + RSI (Relative Strength Index)

- Strategy: Look for Doji at overbought (70+) or oversold (30-) RSI levels.

- Signal: A Doji at these points often indicates a reversal.

- Example: Doji + RSI 75 = potential short trade.

2. Doji + MACD (Moving Average Convergence Divergence)

- Strategy: Use Doji when MACD lines cross or diverge.

- Signal: MACD confirmation can help you enter trades after the Doji.

- Example: Doji + MACD bullish crossover = buy opportunity.

3. Doji + Moving Averages (MA)

- Strategy: Use Doji near key moving averages (e.g., 50 MA, 200 MA).

- Signal: If Doji forms near an MA and price rejects it, a trend reversal might follow.

- Example: Doji at 200 MA + downward trend = potential sell setup.

4. Doji + Bollinger Bands

- Strategy: Look for Doji at upper/lower bands.

- Signal: Price often reverts to the mean after hitting the bands with a Doji.

- Example: Doji at lower Bollinger Band = possible bounce.

5. Doji + Volume

- Strategy: Check volume when Doji forms.

- Signal: High volume = strong market reaction expected.

- Example: Doji + spike in volume = high-confidence trade.

Conclusion

Combining Doji candlesticks with technical indicators increases their accuracy and reliability. Whether you use RSI, MACD, Moving Averages, or Bollinger Bands, always confirm a Doji signal before entering a trade. This approach reduces risk and improves trading consistency.