Introduction

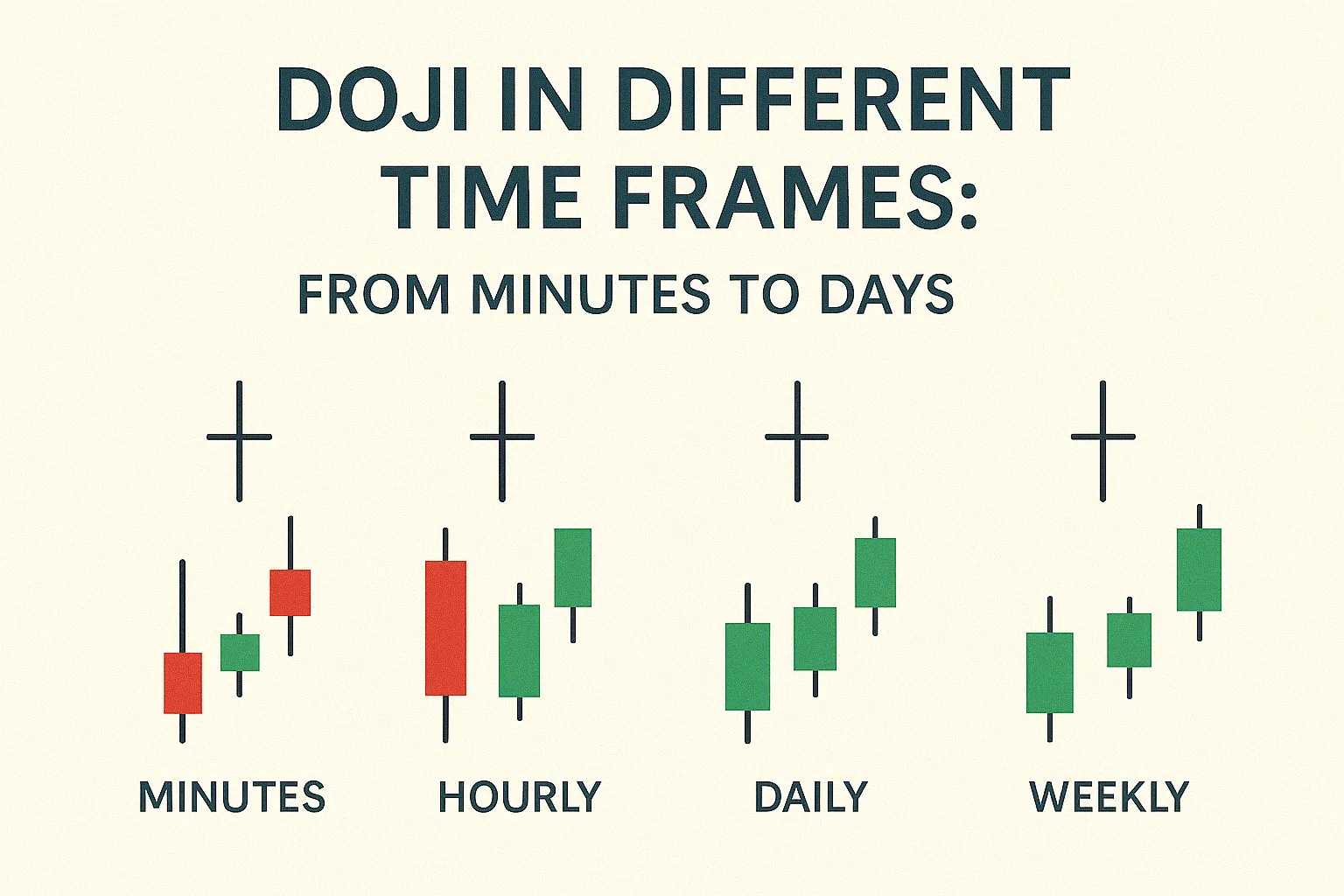

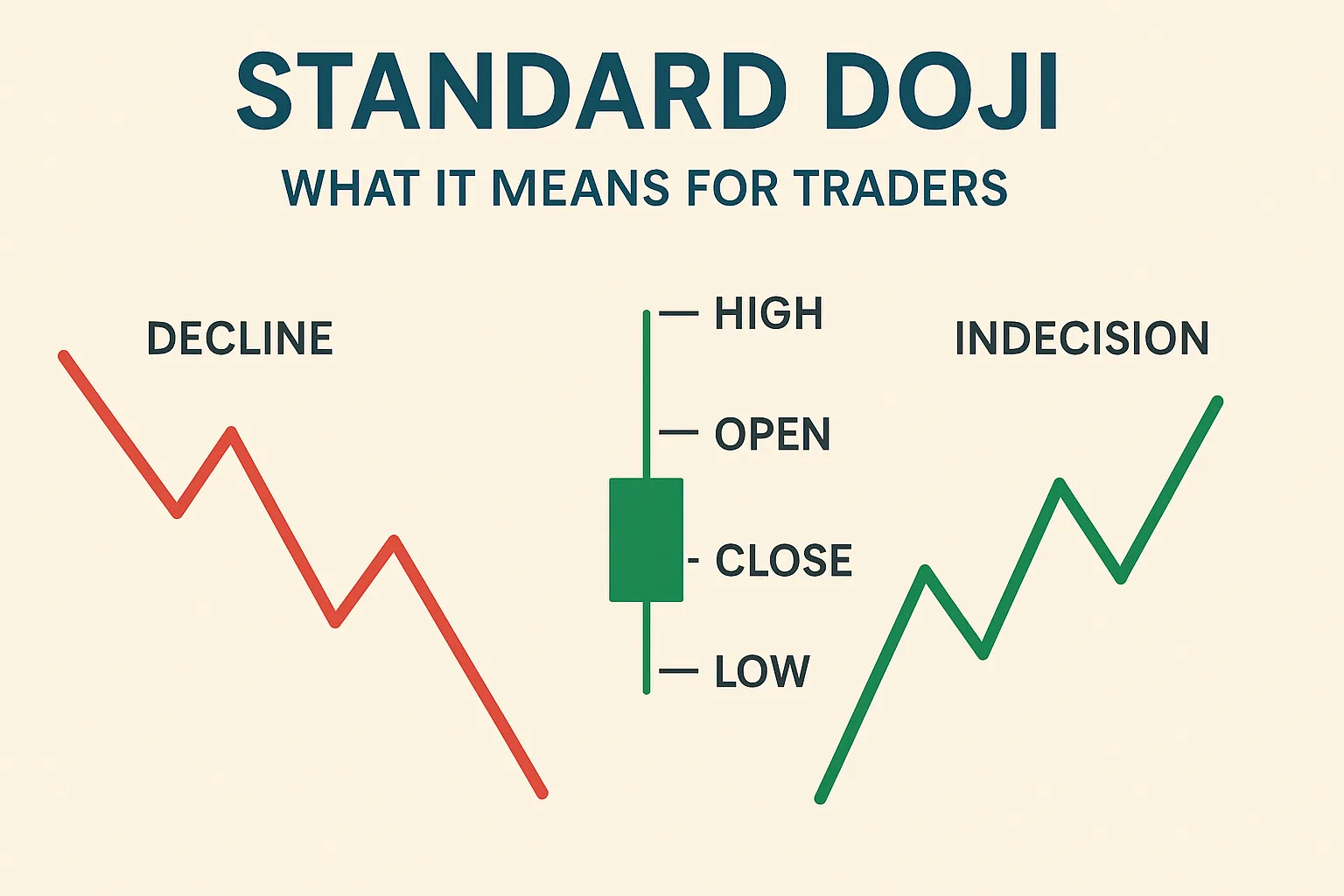

The effectiveness of Doji candlesticks varies greatly depending on the time frame you’re trading. While a Doji on a daily chart may signal a significant shift, the same pattern on a 1-minute chart might be irrelevant noise. This guide explores how to interpret Doji formations across different time frames.

1. Doji on Lower Time Frames (1-Min, 5-Min, 15-Min)

- High Frequency, Low Reliability: Dojis occur frequently due to minor price movements.

- Scalping Use: Some scalpers use Doji on these frames for quick in-and-out trades.

- Tip: Only trade lower time frame Dojis with strong confirmation (e.g., breakout + volume).

2. Doji on Medium Time Frames (1-Hour, 4-Hour)

- Balanced Signals: Dojis are more reliable as they represent more substantial price action.

- Intraday Traders: Ideal for spotting reversals or pauses within daily trends.

- Tip: Use with RSI/MACD to confirm trades.

3. Doji on Higher Time Frames (Daily, Weekly)

- High Reliability: Dojis here often precede major trend changes.

- Swing/Position Traders: Best for making longer-term decisions.

- Tip: Combine with trendlines or moving averages for strong setups.

How to Adjust Your Strategy

- On lower time frames, be cautious. Focus on quick setups with tight stops.

- On higher time frames, look for strong confirmation and set wider stops/targets.

- Volume and context always matter, regardless of the time frame.

Conclusion

Doji candlesticks can provide valuable insights, but their interpretation changes based on the time frame. Always align your analysis with your trading style and confirm Doji signals before acting.