Introduction

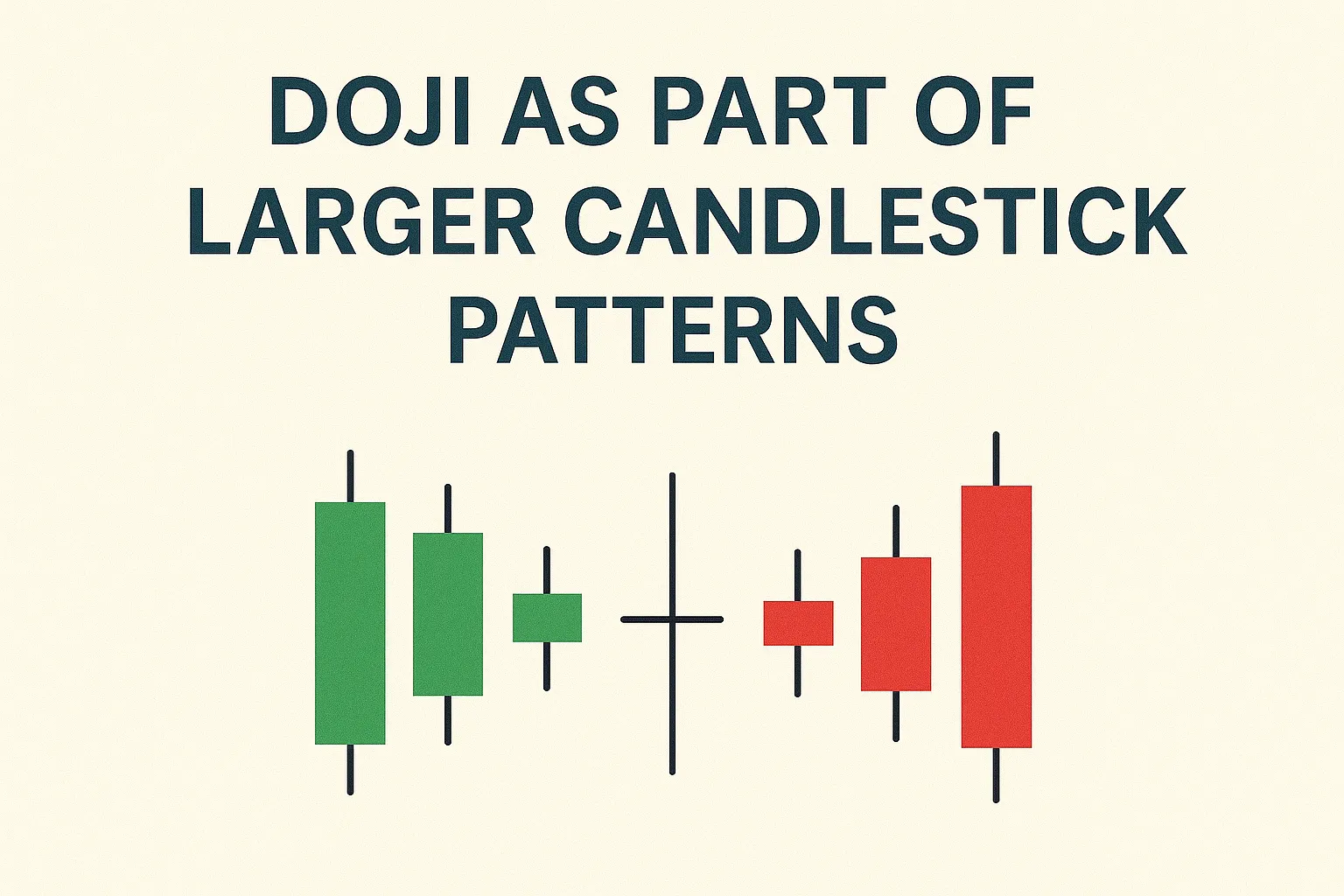

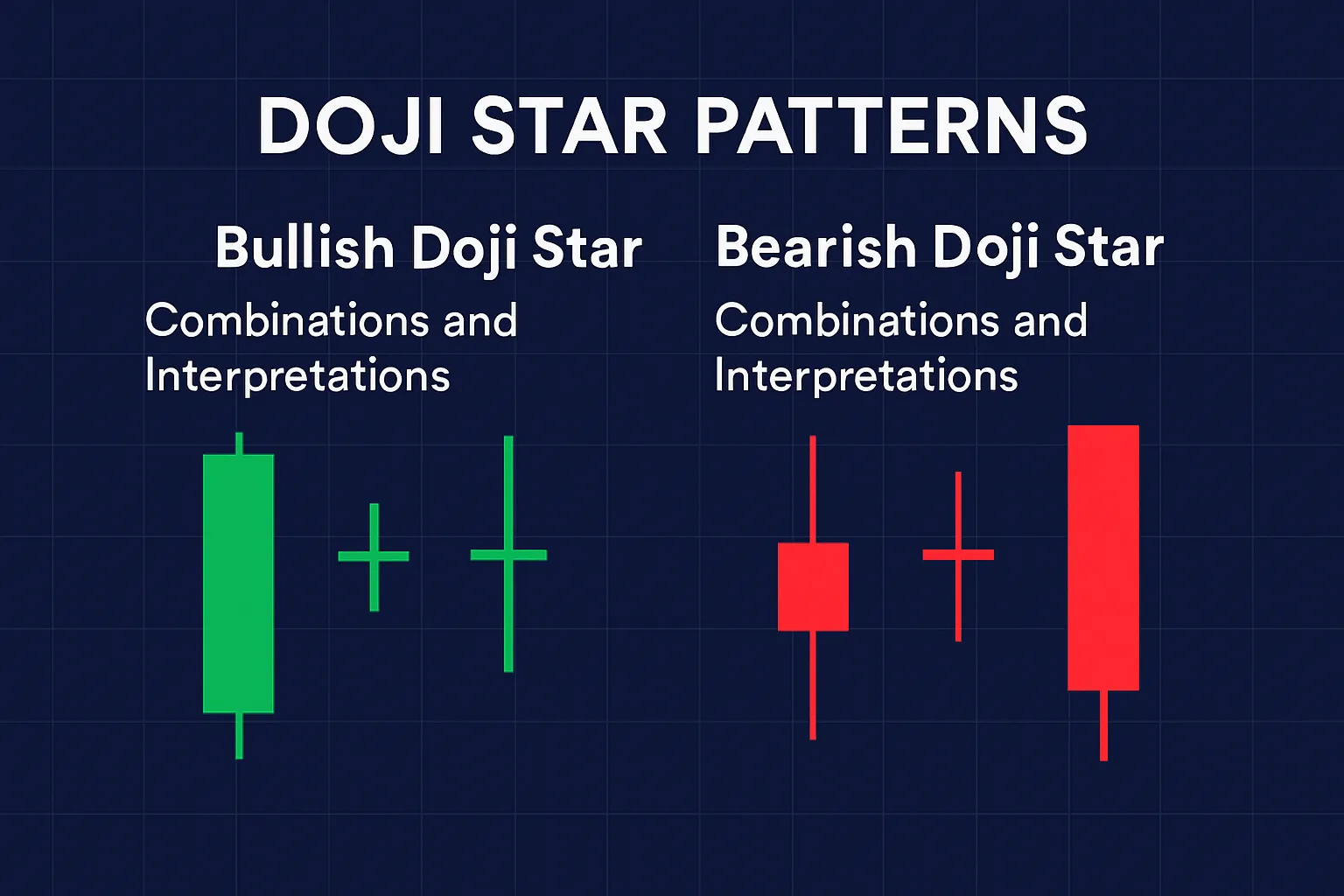

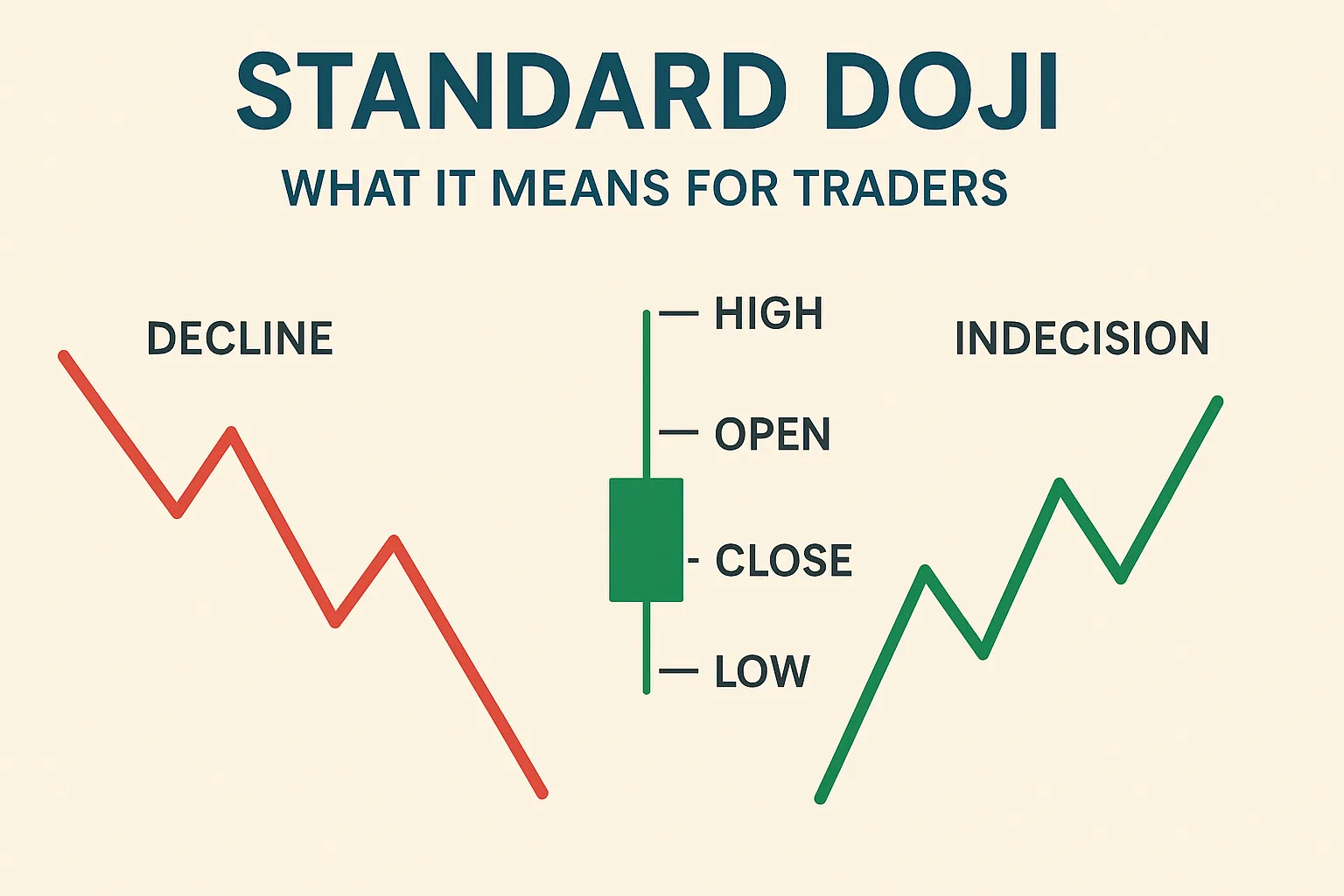

A Doji candlestick can stand alone as a sign of indecision, but when combined with other candlesticks, it becomes a powerful component of larger patterns. Recognizing Doji within multi-candle formations can provide more reliable signals and improve trading accuracy.

Common Multi-Candle Patterns Involving Doji

1. Morning Star (Bullish Reversal)

- Structure:

- Candle 1: Long bearish candle.

- Candle 2: Doji (or small-bodied candle) showing indecision.

- Candle 3: Strong bullish candle closing above Candle 1’s midpoint.

- Signal: Reversal from downtrend to uptrend.

2. Evening Star (Bearish Reversal)

- Structure:

- Candle 1: Long bullish candle.

- Candle 2: Doji (or small-bodied candle) showing hesitation.

- Candle 3: Strong bearish candle closing below Candle 1’s midpoint.

- Signal: Reversal from uptrend to downtrend.

3. Tri-Star Patterns

- Bullish Tri-Star: Three consecutive Dojis at the bottom of a downtrend, signaling potential reversal.

- Bearish Tri-Star: Three Dojis at the top of an uptrend, warning of a downturn.

Why Doji Enhances These Patterns

- Clarity: Doji highlights market indecision, adding weight to reversal patterns.

- Confirmation: Multi-candle patterns with a Doji offer better confirmation than a standalone Doji.

Tips for Trading Larger Patterns with Doji

- Volume: Confirm with rising volume on the third candle.

- Support/Resistance: Patterns at key levels are more reliable.

- Time Frame: Higher time frames offer stronger patterns.

Conclusion

Using Doji as part of larger candlestick patterns enhances your technical analysis. Patterns like Morning Star and Evening Star with a Doji provide clearer signals, helping you make more confident trading decisions.