Introduction

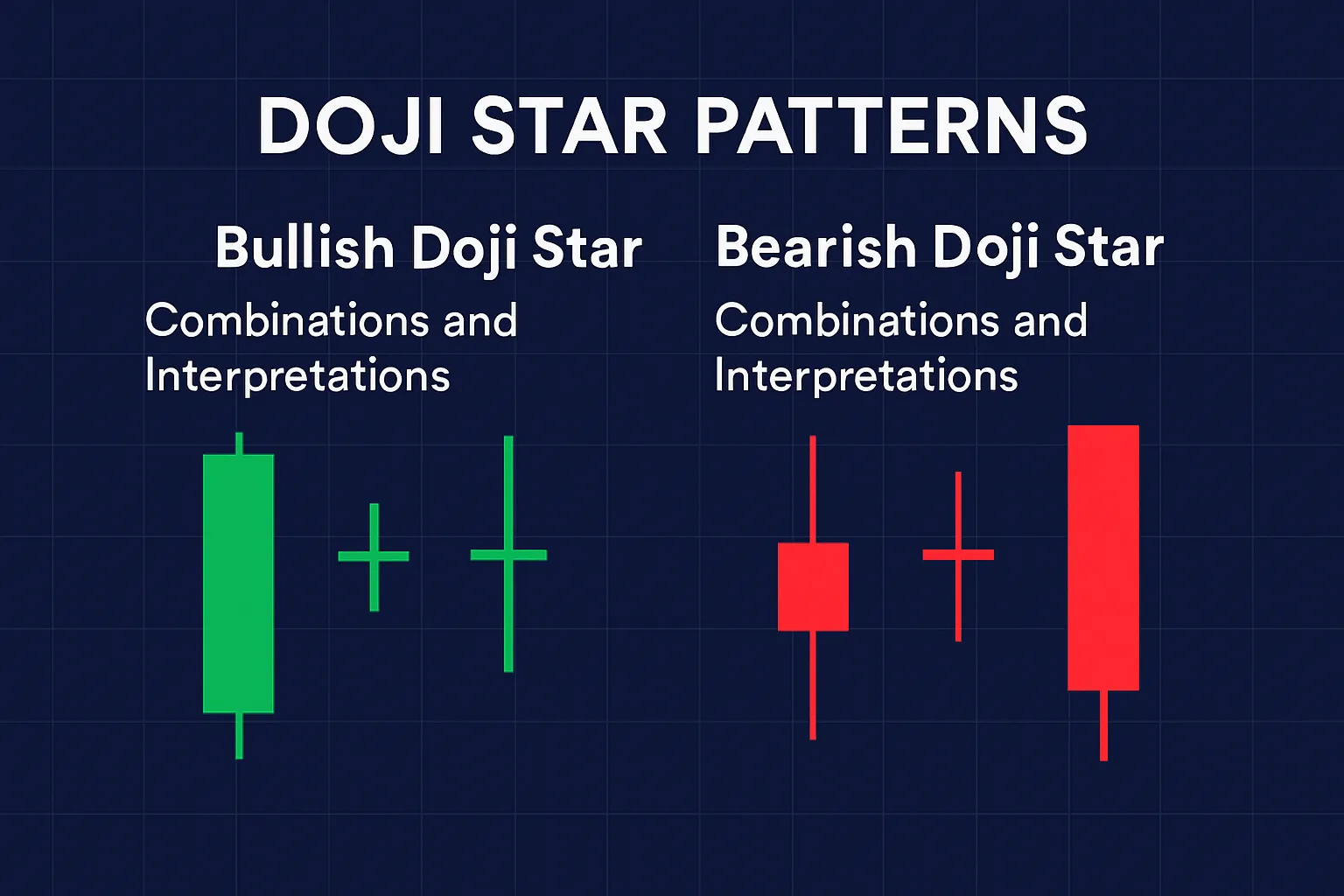

Not all Doji candlesticks are the same. While they all represent market indecision, the shape and position of a Doji can provide more detailed insights into possible price action. This guide will help you recognize and interpret the different types of Doji candles.

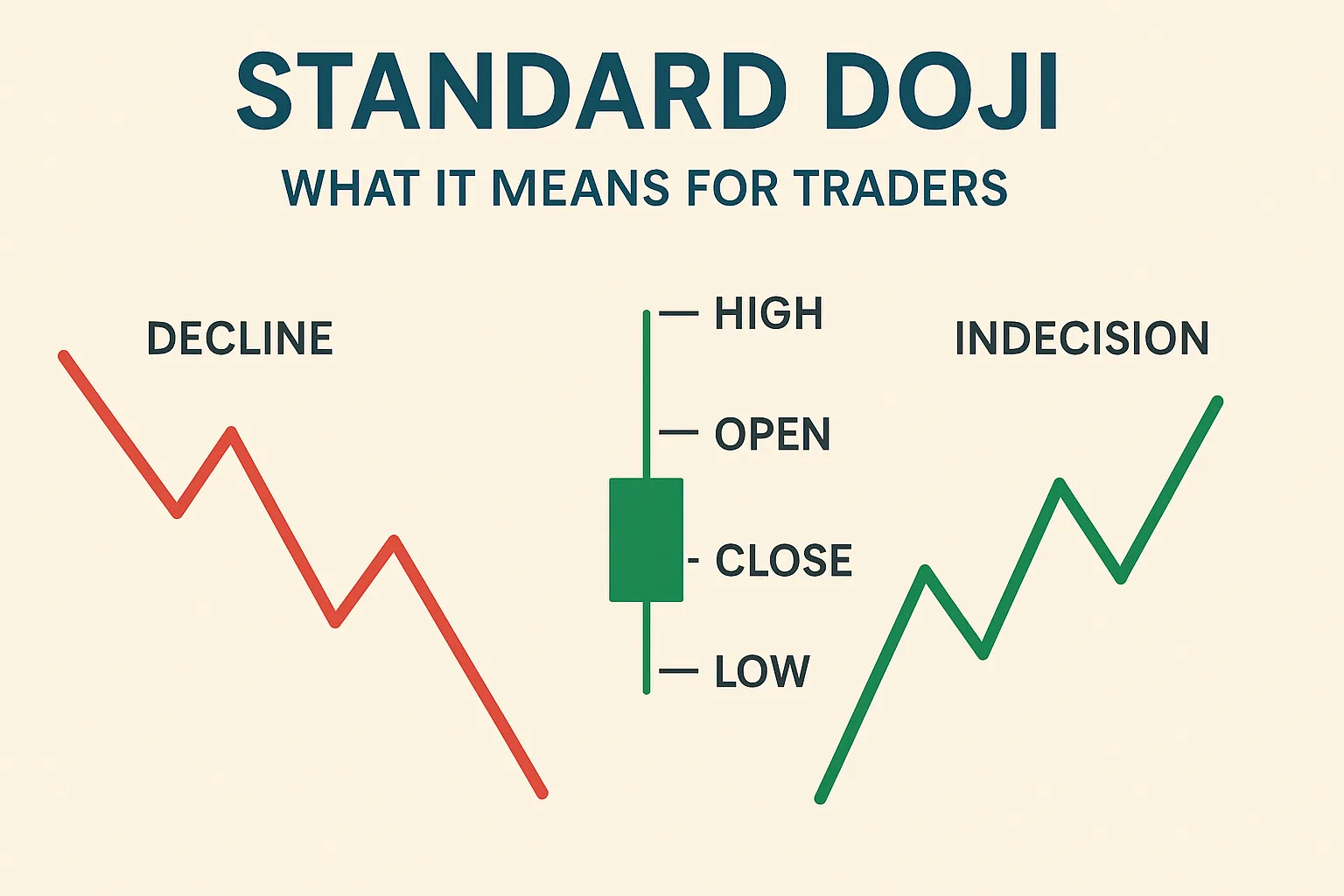

1. Standard Doji

- Appearance: Open and close are nearly identical with short upper and lower wicks.

- Meaning: Pure indecision, often seen in the middle of a trend or during consolidation.

- Use: Wait for the next candle to confirm direction.

2. Gravestone Doji

- Appearance: Long upper wick, little to no lower wick, open and close at the bottom.

- Meaning: Bullish attempts failed, bearish pressure may follow.

- Use: Potential reversal after an uptrend, especially near resistance.

3. Dragonfly Doji

- Appearance: Long lower wick, little to no upper wick, open and close at the top.

- Meaning: Sellers pushed price down, but buyers regained control.

- Use: Indicates bullish reversal after a downtrend, especially at support.

4. Long-Legged Doji

- Appearance: Long upper and lower wicks, open and close nearly equal.

- Meaning: Extreme market volatility, high indecision.

- Use: Be cautious, wait for strong confirmation before acting.

Tips for Identifying Doji Candles

- Focus on the size of the wicks and where the open/close occur.

- Always consider market context—support, resistance, trend strength.

- Combine with volume and other indicators for stronger signals.

Conclusion

Identifying the type of Doji candlestick helps traders better understand market sentiment. Whether it’s a Gravestone, Dragonfly, or Long-Legged Doji, knowing what each one suggests allows for smarter, more informed trading.